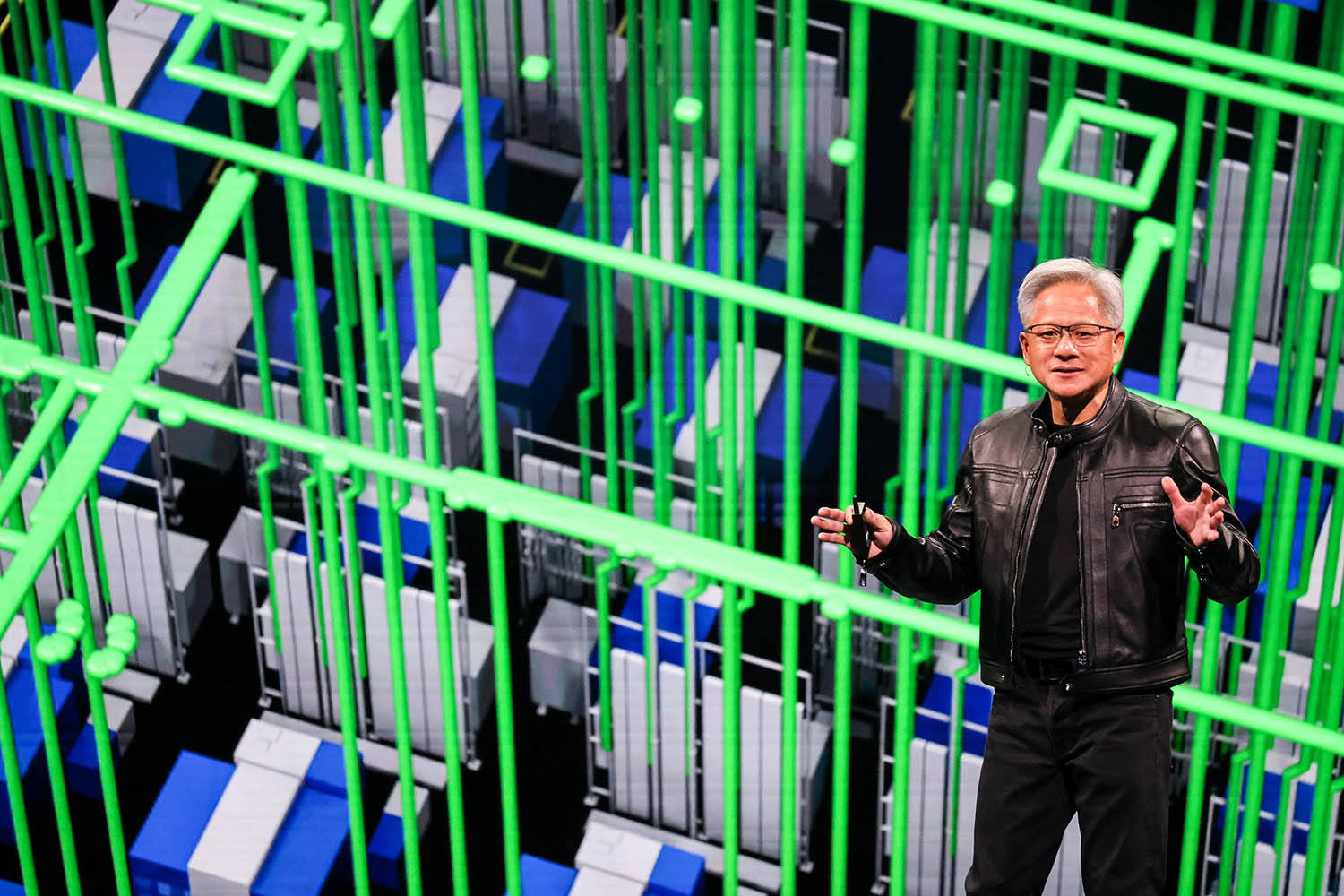

Jensen Huang, co-founder and chief executive of chip-making powerhouse Nvidia, will be the star attraction at London Tech Week, which starts tomorrow on Monday. Last Tuesday, Nvidia again became the world’s most valuable company, with a market capitalisation of $3.45tn – before Microsoft took back the title on Thursday with $3.48tn.

Expect entrepreneurs, investors and policymakers here to hang on his every word, hoping to learn from how Nvidia, established by Huang in 1993, has combined excellence in hardware and software production with prowess at understanding the needs of its customers, enabling the company to position itself perfectly for the current AI boom.

For anyone wondering whether 21st-century Britain could ever create such a dominant global business, it is enlightening to compare Nvidia with a company founded three years earlier in a disused turkey barn outside Cambridge: Arm Holdings.

Judged in purely monetary terms, Arm lags a distant second to Nvidia, with less than one-twentieth of its market cap. And its relative financial weakness would have seen it absorbed into Nvidia in 2020 were it not for regulatory issues with the sale.

Yet Arm’s market value of about $141bn is hardly peanuts. Indeed, its agile, asset-light strategy of focusing on research and development, and licensing its intellectual property (IP) to semiconductor producers, rather than manufacturing its own chips, like Nvidia, has been a triumph.

Its IP has been embedded in 300bn chips so far, in everything from mobile phones to cars to datacentres. With a price-earnings ratio three times higher than Nvidia’s, it is the prospects of the British company that investors seem to be most optimistic about.

Photograph by I-Hwa Cheng/AFP/Getty

Newsletters

Choose the newsletters you want to receive

View more

For information about how The Observer protects your data, read our Privacy Policy