I went to Watford by bus but suffered a medical emergency relating to my disability, so my partner came to pick me up in my car.

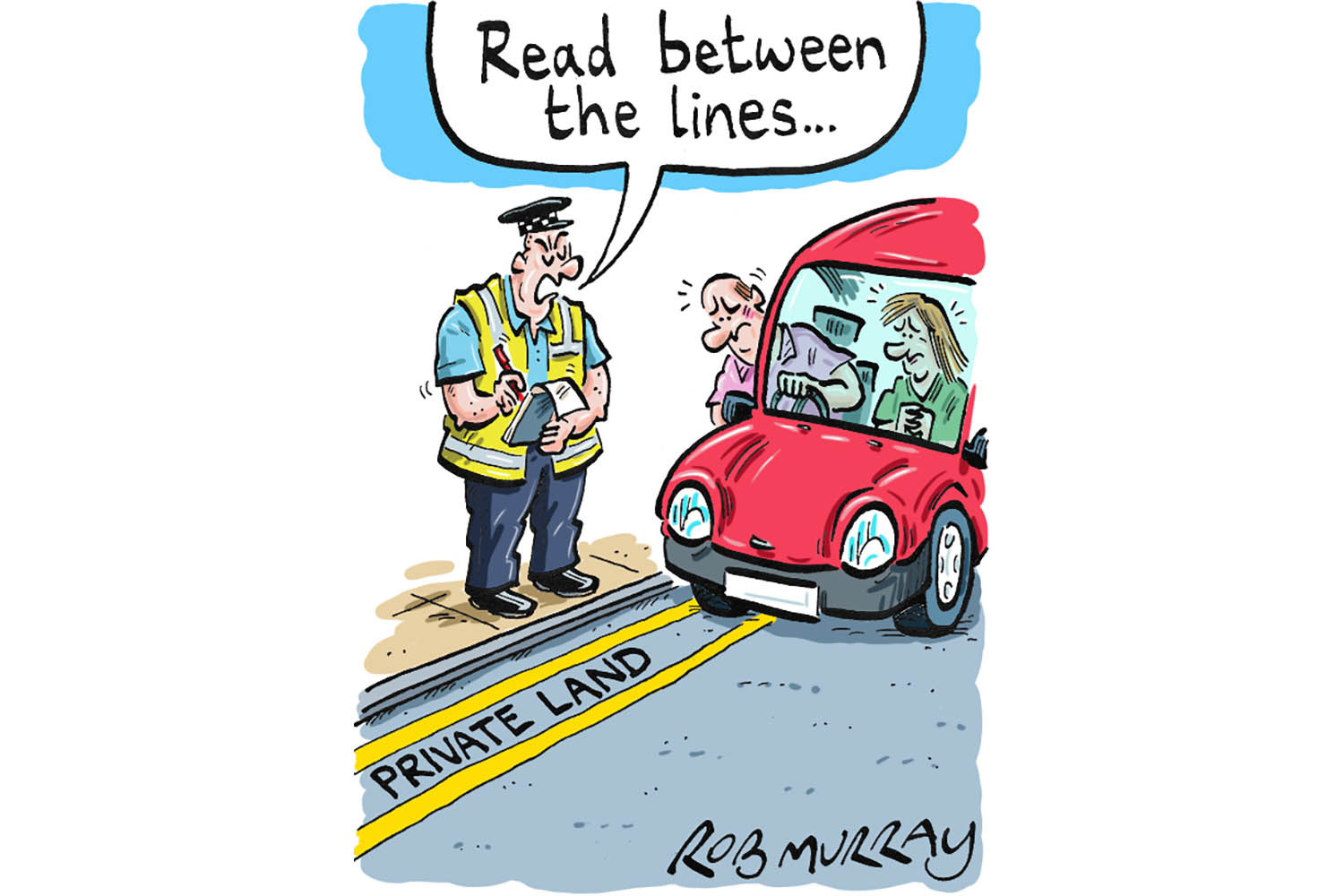

We had arranged to meet in the Sainsbury’s car park but, when he arrived, all of the spaces were full, so he pulled over on double yellow lines for 40 seconds to pick me up. The Highway Code says you can stop on double yellow lines to pick up passengers. I then received a penalty charge for £100.

Despite explaining the situation to the car park manager, CUP Enforcement, it refuses to budge.

I don’t find the Highway Code particularly clear about double yellow lines, so I asked the Department for Transport for clarification.

It said on public roads, double yellow lines signify no parking or waiting at any time, but (confusingly) you can stop to load or unload goods, and you can also stop briefly to pick up and set down passengers, unless signage or yellow “kerb dashes” indicate otherwise.

Blue Badge holders can park for up to three hours, provided they don’t cause an obstruction. This is set out on the government website, Know Your Traffic Signs. According to this, you should have been fine, but your double yellow lines were on privately owned land, where the Highway Code doesn’t apply. The Ministry of Housing, Communities and Local Government says off-street car parks, such as those provided by shopping centres, are managed under contract law. “Owners of private land can impose their own rules and regulations, which can include prohibiting parking on double yellow lines and issuing PCNs for violations,” it said.

By the time you contacted me, Popla, the independent appeals handler for parking charges, had found in favour of CUP and your fine had risen to £140. After I told CUP about your disabilities and the fact you had been taken ill at your optician’s, it agreed, begrudgingly, to reduce this back to the original £100.

You have decided to pay rather than continue the argument as your partner has been in a serious motorcycle accident and you have more important things to worry about.

Teachers’ Pensions is dead wrong about me

I am a retired teacher and wrote to Your Problems a month ago because my pension provider, Teachers’ Pensions, required me to demonstrate that I was still alive, otherwise my pension would be stopped. I have received the same threatening letter for four years.

In response to my formal complaint last year, Teachers’ Pensions wrote: “There is possibly an individual on the General Register Office’s records (of births, deaths, marriages in England and Wales) with the same name living within a 10-mile radius of a member’s address that had been registered as having died.” It added that this will continue to happen in future if such matches continue to be found.

Newsletters

Choose the newsletters you want to receive

View more

For information about how The Observer protects your data, read our Privacy Policy

I find it deeply distressing to be persecuted year after year when Teachers’ Pensions and the General Register Office have ample means to confirm whether if I am alive or dead. Teachers’ Pensions has now stopped my pension payments because I did not reply to the two letters it sent in March.

Your payments were pension was reinstated after a few days, but even a short delay can cause chaos for regular payments coming out of your bank account.

Capita, which administers the scheme, said: “When General Register details suggest a beneficiary has died, we check the date of birth and address data. Where details potentially match a deceased record there may be some conflicting elements, but if there are some matching elements, it is highlighted as being of potential interest. We then write to the member to confirm. If we do not hear from them, we will follow up with a reminder letter before suspending payment.”

So even if your details do not match those of the deceased, you could still end up getting a letter. I am not aware of any other pension scheme requiring members to prove they are still breathing on the basis of such flimsy information.

I asked Aviva how it checked on its members’ status. It said it uses search tools to scans publicly available data for unique identifiers, including name, date of birth, NI number and full address, death certificates or probate and wills to determine whether a customer is deceased.

Why is Teachers’ Pensions using such a vague way to identify members who might have died? It is no doubt cheaper than carrying out thorough checks, but its cost in stress felt is very expensive indeed.

If you would like advice from Jill, please email your.problems@observer.co.uk, including an address and phone number. Submission and publication are subject to our terms and conditions.