Over the course of the last eight months, Justin Sun, a Chinese-born billionaire best known for paying $6.2m for a banana at an art auction, made another series of unusual investments. He spent $75m buying crypto tokens from World Liberty Financial (WLF), a firm backed by the Trump family.

Five weeks after Donald Trump became president, the US securities regulator shelved a civil fraud case against Sun that could have cost him millions in fines and repayments.

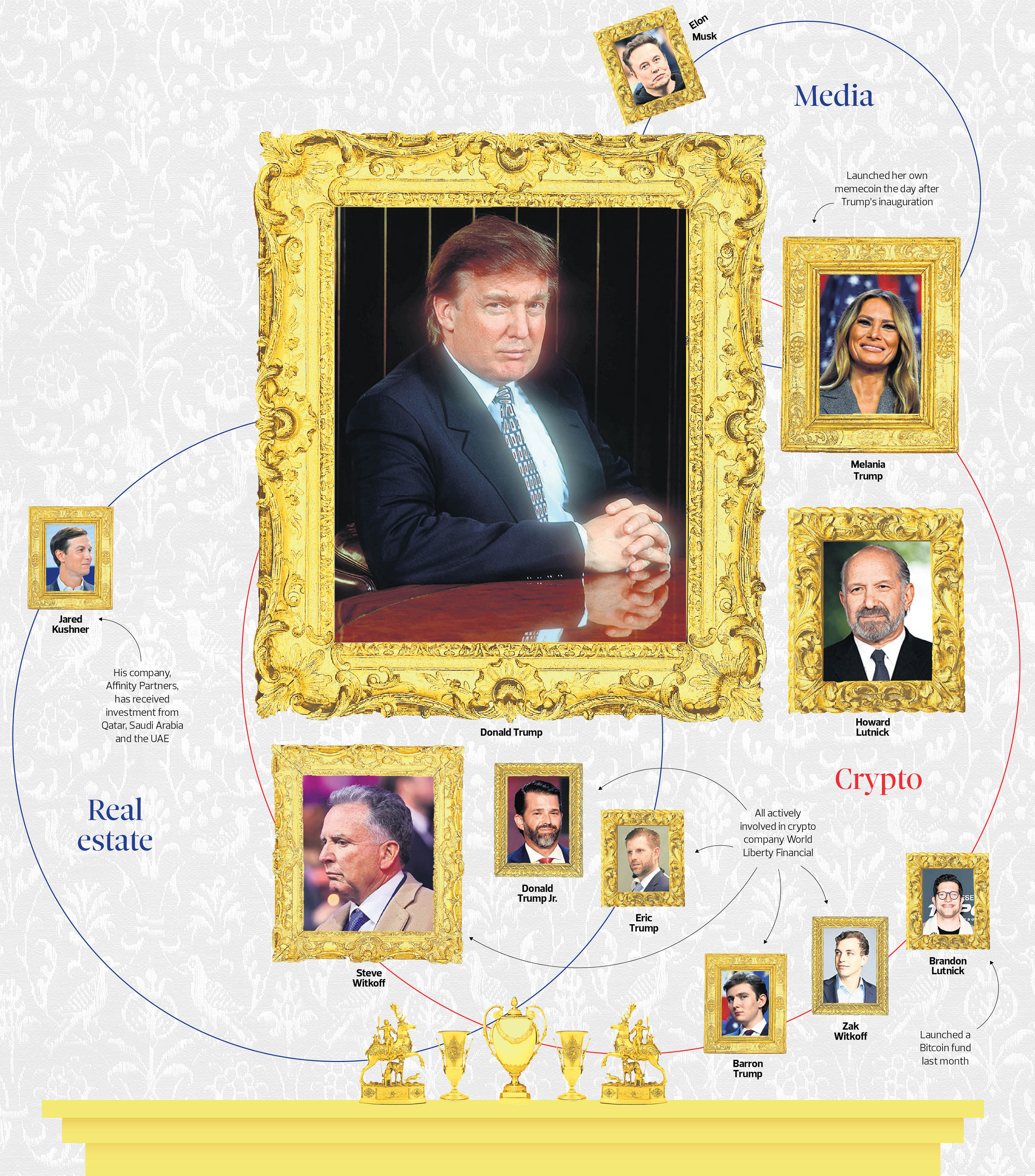

When it was founded last year, WLF promised to liberate Americans from “the big banks and financial elites”. The firm listed President Trump as “chief crypto advocate”; his sons as “visionaries and ambassadors”; and the two sons of his Middle East envoy, Steve Witkoff, as cofounders. Witkoff Sr was listed as “cofounder emeritus”.

Now the Trumps, the Witkoffs and Sun – the banana-buyer – are in business together. Sitting beside Sun and Eric Trump at a crypto conference in Dubai this month, Zach Witkoff, Steve’s son, announced a new deal. It involved a crypto token called Tron, whose price Sun had been accused of manipulating in the shelved fraud case.

“Tron is just an incredible technology,” Witkoff Jr said, “and we’re lucky to be partners with you.” There is every chance that a WLF-Tron partnership will enrich Sun, President Trump, his family and the family of his advisers.

Every president since Lyndon Johnson has chosen to sell his investments before taking office or seal them in a blind trust – except Trump. Forbes estimates that his personal wealth has more than doubled to $5.1bn in the past year. Trump profited from his businesses during his first term too, but sources say the majority of his net worth is in new schemes launched in the past year – deals, often facilitated by his sons, in crypto, real estate, media and the use of Trump’s existing assets including hotels and his Mar-a-Lago mansion.

In every case, conflicts of interest lie in plain sight, experts say, as Trump’s sons and their friends and associates are seen as seeking private gain from their proximity to his public office. But in none of the cases has the US justice or financial regulatory system managed – so far – to hold them to account.

‘ It’s like the days of aristocracy, with a king and his dukes’

‘ It’s like the days of aristocracy, with a king and his dukes’

Jordan Libowitz of Citizens for Responsibility and Ethics in Washington

“This is the golden age of corruption in America,” says Anthony Scaramucci, Trump’s former communications director.

“ It really brings us back to the days of aristocracy, where you had a king and his dukes and barons,” says Jordan Libowitz of Citizens for Responsibility and Ethics in Washington (CREW). “There is no real differentiation between government policy and personal wealth.”

Crypto

At that same crypto conference in Dubai, the Trump-Witkoffs announced that a fund backed by Abu Dhabi would be making a $2bn business deal using a stablecoin belonging to World Liberty Financial. WLF’s digital coin would be used to enable MGX, the Emeriti fund, to buy into Binance, a crypto exchange operating under US government supervision since 2023, after admitting to violating federal money-laundering laws. In addition to the UAE, WLF has partnerships with crypto companies based in Hong Kong and Israel, among others.

Newsletters

Choose the newsletters you want to receive

View more

For information about how The Observer protects your data, read our Privacy Policy

A company “affiliated with Donald J. Trump and certain of his family members” owns 60% of WLF, according to its website. Libowitz says this gives investors “ the ability to direct millions of dollars directly to Trump”, potentially giving them leverage over the president, as they can inflate or deflate the value of his holdings. “ We know Trump cares deeply about what his net worth is and where it puts him on a list of billionaires,” Libowitz says.

WLF is the speartip of Trump’s crypto interests. Days before his second inauguration, $TRUMP and $MELANIA memecoins made millions for Trump-affiliated companies, which own 80% of all stock in the coins and stand to benefit when their prices rise. (A memecoin is a digital currency whose value is driven by hype rather than limited supply.) Later this month, Trump will host a dinner at Mar-a-Lago for 220 of $TRUMP’s biggest investors. The announcement of that dinner led one investor to plough more than $24m into the coin.

Since his second inauguration, regulatory rules for crypto that could inflate the value of Trump’s holdings – and those of his sons – have been rewritten. The latest, a stablecoin bill, narrowly failed to clear a vote in the Senate this week. Democratic senator Elizabeth Warren said it would “make it easier for the president and his family to line their own pockets. This is corruption and no senator should support it.”

A White House spokesperson denied any conflict of interest.

Real estate

It wasn’t just crypto deals that Eric Trump secured during his recent trip to the Middle East. This month, the Trump Organization – a conglomerate of more than 500 companies – announced three Trump-branded real estate projects, including a $5.5bn deal to build a beachside golf resort in Qatar made up of a 7km-long entertainment district, an 18-hole golf course and a “Land of Legends” theme park. The deal is led by Qatari Diar, a real estate company owned by the country’s sovereign wealth fund.

The Trumps have a stake in a similar project in Oman, which has drawn scrutiny for its treatment of workers, and in the past months they’ve signed property deals with Dar Global, a developer with ties to the Saudi Arabian government, in Jeddah, Riyadh and Dubai.

While Eric was in the Middle East, Don Jr visited Hungary, Bulgaria, Romania and Serbia to expand his family’s business network, including by announcing plans to build a Trump hotel in Belgrade. The hotel project is backed by the private equity firm Affinity Partners, which was founded by the president’s son-in-law Jared Kushner. (Kushner left the White House in 2021; since then Affinity Partners has received large investments from governments including Qatar, Saudi Arabia, and the UAE to invest in global real estate and tech. Last year its assets grew 60% to $4.8 billion.)

Twenty Trump-branded real estate projects will be developed in foreign countries during Trump’s second term as president, including in India, Uruguay, Oman and Vietnam, according to CREW.

Next week, Donald Trump will follow in Eric’s footsteps and visit Saudi Arabia, Qatar and the UAE – all of which are home to Trump-branded projects and ongoing developments. Reuters reports that an arms package for Saudi Arabia worth well over $100 billion could be announced during the trip.

“In the American experience, we have never had a president with such egregious conflicts of interest since the civil war,” says Richard Painter, chief White House ethics lawyer under George W Bush. Experts are concerned that Trump Organization dealings might influence foreign policy. Previous financial disclosures have shown that the president directly benefited from similar real estate deals, but the White House has argued that “there are no conflicts of interest” because “the president’s assets are in a trust managed by his children”.

The Trump Organization appointed an outside ethics lawyer, William Burck, to review any contracts worth more than $10 million – although President Trump has called for him to be fired for representing Harvard University in its lawsuit against the government. Eric Trump has said the business “is dedicated to not just meeting but vastly exceeding its legal and ethical obligations during my father’s presidency”. He won’t be involved in next week’s presidential visit to the Middle East: “I keep total separation. I want nothing to do with politics or policy.”

“It’s laughable that the left-wing media thinks that I should lock myself in a padded room while my father is president and cease doing what I’ve been doing for over 25 years to earn a living and provide for my five children,” Don Jr said in a statement to The New York Times.

Media

Trump is the majority stakeholder in Trump Media and Technology Group, the publicly traded company that owns his social media site Truth Social – via a trust managed by his son, Don Jr. He is eligible to sell shares including, if he wishes, to foreign investors. Truth Social could also profit from advertisers, who may seek to curry favour with the president.

TMTG shares peaked at $50 before the election and have since fluctuated wildly. Today they’re trading at around $25, valuing the business at $5.5bn.

Trump has also extracted income from his competitors through litigation. In January, the social media company Meta reportedly paid $25m to settle a lawsuit over his 2021 social media suspensions, raising concerns about preferential treatment. The majority of the settlement – $22m – will go toward a fund to pay for Trump’s presidential library.

A month later, X (formerly Twitter) paid the president – personally – about $10m to settle a similar lawsuit. That month, Trump appointed Elon Musk as a White House adviser despite Musk’s companies being subject to federal regulation.

Earlier this year, Trump sued CBS News for $20bn, alleging media bias in favour of Kamala Harris, while the FCC – led by a Trump appointee – is investigating ABC and NBC for their coverage and debate moderation during the 2024 election. CBS’s parent company, Paramount-Skydance, is run by David Ellison – son of the billionaire Larry Ellison. It is reported that the company is laying the groundwork to settle the CBS lawsuit. Ellison Sr, meanwhile, is in a strong position to buy the US-arm of TikTok, provided the deal eventually goes through.

Other associates of Trump are also making media deals that could materially benefit the president, his companies or his family. Amazon – whose founder Jeff Bezos courted Trump during his campaign – is paying a reported $40m for a documentary about Melania Trump, who will be an executive producer on the project. The details of her financial participation have not been made clear.

Any other business

During Trump’s first term in office, one congressman called the Trump International Hotel, “a billboard for conflicts of interest”. Back then, the Secret Service approved a room rate for its staff – who were frequently obliged to stay there – of “more than five times the approved government per diem rate”. That hotel was sold in 2022. Eric Trump is in talks to buy it back.

In 2024 Trump filed a public financial disclosure which revealed that his businesses took in more than $700m between January 2023 and August 2024. That included a $300,000 royalty fee for promoting country musician Lee Singer’s Bible, $513m from his golf clubs and resorts, and nearly $6m in revenue from his Truth Social holdings.

It is clear that that income has skyrocketed since he took office. It’s impossible to say by how much, because Trump is the “ least transparent president with his finances in generations” Libowitz says. We know that, in addition to his sprawling crypto, media and real estate ventures, Trump’s businesses have made money from merchandise – including perfumes, Trump 2028 caps and NFTs – and events held at his properties.

In March, Trump invited business leaders to dine with him at Mar-a-Lago for a reported $5m a head. A separate “Crypto & AI Innovators Dinner” charged $1.5m per plate, and another “candlelight dinner” charged $1m. White House officials have reportedly spoken to Keir Starmer about hosting the 2028 Open golf championship at Trump’s Turnberry course in Scotland, after repeated requests from the US president.

Trump has gone through the motions of distancing himself from his business empire by handing control to his sons. The White House has emphasised this several times.

But perhaps he doesn’t have to – the main law prohibiting conflicts of interest explicitly excludes the president.

“The law’s totally on my side, meaning, the president can’t have a conflict of interest,” Trump said in 2016. Last July, the Supreme Court granted the president sweeping immunity for “official acts”.

Trump and his supporters have consistently targeted Hunter Biden for his involvement with the Ukrainian firm Burisma during his father’s vice presidency. In practice, it doesn’t appear that Trump has distanced himself adequately from similar entanglements. Libowitz says Don Jr and Eric are his agents: ”their job is to make money for the president”. He calls it “a troubling level of corruption”. Several others used the same word.

Ethics lawyers say Trump’s outside business interests could represent a violation of the US Constitution’s “emoluments clause”, which is designed to prevent government officials from receiving gifts, payments, or other benefits. Here, the president is not exempt. Several lawsuits filed during his first term alleged that he violated that clause, but those suits were dropped when he left office. Any legal battles would have to start afresh.

Additional reporting by Barney Macintyre

Photograph by Scott McIntyre/The New York Times/Redux/eyevine