This is the first article in a series. Read the others here.

It is brutal. The government has five weeks to find about £30bn additional revenue a year, by the end of this parliament, if it is to meet its target that the stock of public debt must by then fall as a proportion of national output. British government bonds already languish as the least desired, with the highest interest rates in the G7 group of industrialised countries. It is this menaced fiscal rule that stands between the government and the possibility of a bond-market crisis.

So high are the stakes for the budget – the set of choices will frame the fate of this government – that the prime minister and chancellor quickly decided that anyone with serious economic policy responsibility should be included in a broad “budget group”. Everyone’s hand is to be dipped in blood.

Torsten Bell, pensions and treasury minister, has emerged as the group’s pivotal figure, invited by the chancellor to act in practical terms as its executive lead. Rachel Reeves has let it be known that she considers him one of Labour’s “sharpest minds” and someone who has “seen the budget from both ends: in the room helping to write [it] and on the Today programme dissecting [it]”.

Before becoming an MP, he authored a trenchant and influential report, Stagnation Nation, as chief executive of the Resolution Foundation thinktank, which he followed up with a no less trenchant book, Great Britain?. We know what the de facto author of the budget thinks of the challenges and options in granular detail. It is all written down.

The budget group has not yet made its decisions, but it has set out its priorities. The chancellor wants to try to convince business that she’s serious about growth – one of the mantras of the budget group is “unleash the private sector”. Officials know that the most efficient way of raising big sums of money is to raise income tax or VAT, but that means ripping up Labour’s manifesto commitments not to increase income tax, VAT or national insurance.

Ministers were already convinced that breaking manifesto promises would haunt them: a Treasury-commissioned poll to see what the public response would be to going back on those pre-election promises in the national economic interest confirmed their view. It will not wash. So the group is zeroing in on fundamental reform and significant taxes on property and the housing market, changes to savings and gifting, and new levies on the wealthy and particular industries such as gambling.

No wealth tax – but increases in property tax inevitable

Housing wealth has more than doubled in relation to GDP over the last 45 years, but the proportional increase in domestic wealth-related taxes has scarcely budged. As Bell has told the group, one consequence is that Britain has the highest average price of property per square metre in the advanced world – not just London and the south-east, but across the country as a whole. It is not only that Britain does not build enough, which Labour is trying to remedy – property is far too lightly taxed. A graph he used in both the report and his books underlines his argument, and is central to the budget.

But Bell is against a wealth tax such as a small annual levy on personal wealth above, say, £10m. Wealth taxes “have proved hard to collect and tough to sustain politically,” he wrote. “A better place to start is making the wealth taxes we have work properly.” The chancellor has also said as much.

His primary target is the broken council tax system. His preferred policy would be to replace council tax with a tax levied proportionally on today’s property values, currently off the table because there has not been a revaluation of residential property values since 1991 in England and 2003 in Wales. The system is mad. Council tax revenues could be as much as £30bn higher based on 2025 property prices.

Newsletters

Choose the newsletters you want to receive

View more

For information about how The Observer protects your data, read our Privacy Policy

But there is no sign this risk-averse government wants to do anything so potentially beneficial. It is too politically toxic. The Welsh government beat a retreat on the idea only last year given the extent of opposition. Instead it is left with the option of adjusting council tax bands. Doubling the rate of council tax in bands G and H, affecting 4% of homes given the system’s absurdities, would for example, according to the Institute for Fiscal Studies (IFS), raise £4.2bn by 2029-30. Introducing a band I on property with a value in excess of, say, £1m could raise up to another £1bn.

The administrative problem is that council tax is paid to local not central government. One option is the introduction of a national property levy on homes in bands G, H and a new band I paid directly to central government – which would be presented as a national levy on the “broadest shoulders”. To sweeten the bill, some of the proceeds would be earmarked to lower residential stamp duty.

Kemi Badenoch, the Conservative leader, promised at the party’s conference to scrap stamp duty; Treasury officials believe she did that, in part, because the Tories had got wind of the government’s plans to roll back George Osborne-era increases to stamp duty which have depressed the housing market, particularly the top end. In a budget that will have some bitter pills for the wealthy to swallow, this is intended to be a sweetener.

Lifetime gifts, tax-free pension lump sums and tax-free cash Isas

The government still needs more cash. One of Bell’s early initiatives as CEO of the Resolution Foundation was the establishment of the Intergenerational Commission. A sizeable source of wealth inequality, it argued, is the passing of major gifts by rich parents to their children, running at an estimated £9.6bn last year, which incur no tax after a seven-year grace period. It is a forerunner of what will be a great wealth transfer running into trillions as the baby-boomer generation dies away – and largely untaxed.

To address the problem, the commission proposed the introduction of a lifetime receipts tax, under which recipients would declare gifts as part of their annual income (as France does) on which they would be taxed as if it was income, and with the grace period annulled. This could raise at least £2bn, steadily rising in the years ahead.

It also proposed that the right to withdraw a tax-free lump sum from up to a quarter of a retiree’s pension fund should also be reduced, along with the generous reliefs on farm, pension and business inheritance. As a tribute to Bell’s influence, Reeves acted on the last recommendations in her first budget. Actively under discussion is the idea of scaling back the tax-free pension fund lump sum to £100k, worth £2bn a year to the Treasury. The allowance could remain if the pension fund of which a retiree was a member had invested at least a quarter of its share investments in British companies. This principle could also be extended to Isas: tax-free cash to be allowed only to the extent there is a commensurate investment in British shares.

And a lifetime receipts tax? It would be enough to pay for the abolition of the detested two-child cap on benefits, an attractive transfer from rich to poorer children – a concept which is dear to Bell’s heart. Chancellors under pressure often produce a new tax, but this may be a radical step too far. The most likely outcome is a compromise, extending the qualifying grace period on gifts to 10 years rather than seven. But Reeves may just dare – less toxic than inheritance tax, much more easily defensible, and a rich new revenue stream.

Tried and trusted taxes – and new ones

To raise the full £30bn, the freeze on income tax allowances and thresholds will have to be extended to the end of the parliament. And after baulking at raising excise duties, notably on petrol and diesel, in line with inflation for more than a decade, the nettle will finally be grasped. Every year, the Sun campaigns to freeze fuel duty once again. The budget group is seriously considering breaking that bad habit and restoring the fuel duty escalator.

Gordon Brown, who as a long-time inhabitant of No 11 knows the tax options that Treasury officials serve up every budget, has been campaigning hard for a gambling tax, one that enables the government to lift the two-child benefit cap that is such a measurable contributor to child poverty. It’s an argument he looks set to win. Expect substantial hikes to remote gaming duty, machine games duty and general betting duty on non-racing bets. Count all that in and the target can be reached.

How will it land? The key is the bond markets. Already as the shape of the budget emerged last week, the bond markets were taking heart; the crazed hyperbole about another IMF crisis is receding. Britain will be in better fiscal shape than both the US and France. British business will come off lightly and the average British worker will scarcely suffer a dent in their real income, although higher petrol prices will draw much ire.

The chancellor also promises to revisit cutting welfare spending. The losers will be owners of expensive homes, children of the wealthy and baby boomers approaching retirement.

Will it demonstrate the government’s vision and purpose? It is certainly trying to promote more fairness, while reassuring the markets – so it will pass those tests. But there is a trillion-pound tech economy to build and a nation to be levelled up, and the lives and life chances of working people to be improved. Much more to be done before the government can breathe more easily.

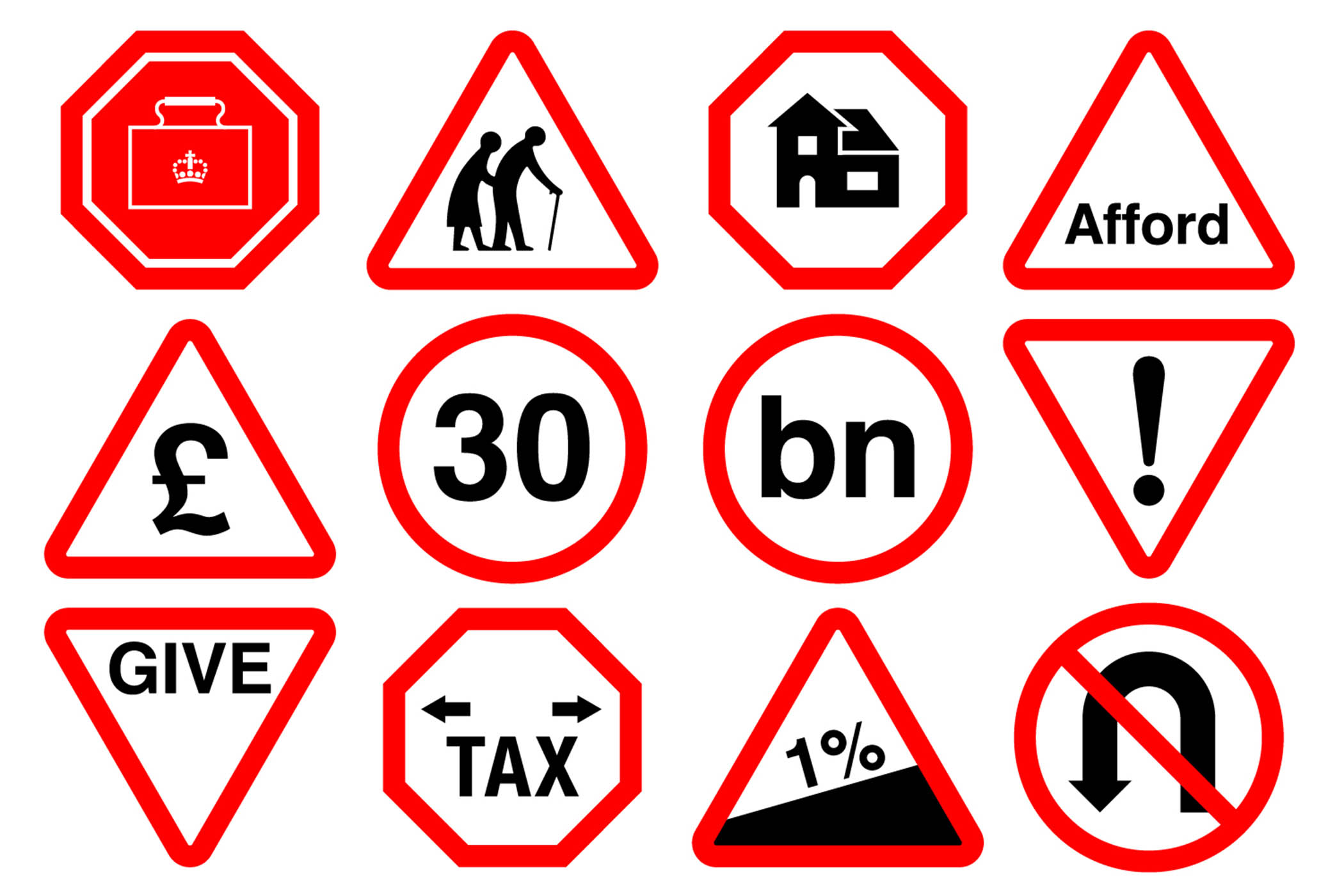

Illustration by Chris Newell