Nigel Collier knew he had a good idea. The Cambridge professor had found a way to help firms that design large language models, the technology that powers AI chatbots such as ChatGPT, evaluate their data by applying principles used in human IQ testing. But he needed a way to show that it worked – and money to do it.

Many UK university spinout companies face a similar problem: they have a good idea but struggle to prove it works. Their concepts are too advanced for research grants but too early for seed funding, and they fall between the cracks.

Cambridge University’s technology investment fund (TIF) is a way to address the problem. The in-house fund was given five years and £10m from university coffers to help take its most entrepreneurial ideas from conception to proof-of-concept.

“The feedback we often get from investors is that an idea hasn’t been de-risked enough,” said Tom Mentlak, head of the fund. The TIF borrows from similar models at Stanford and the Massachusetts Institute of Technology (MIT), which launched similar funds a decade ago.

In venture capital terms, the amounts offered by the TIF are small: the average for the 40 or so projects that have so far raised funding is about £100,000. Collier’s project, Trismik, used its funding to hire external software engineers to build the first version of its product. “It enabled us to take what was essentially an idea in the laboratory and turn it into some software that we could show to potential business customers or investors,” he said.

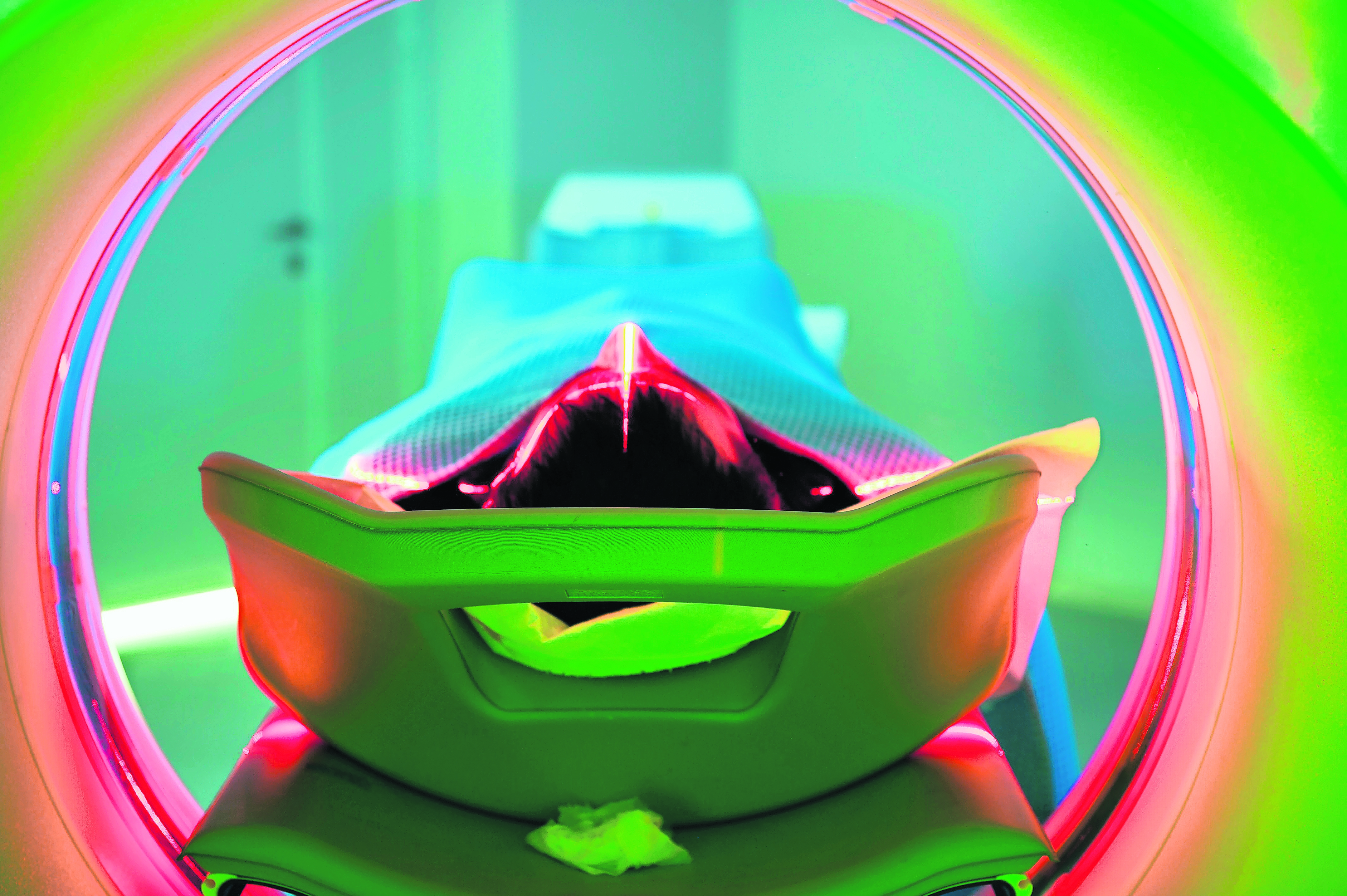

Two years in there are signs that the university’s strategy is working. The TIF has so far awarded £4m to the 40 projects. Of those, Trismik has raised £2.2m in pre-seed funding, while Cellestial Health, which is developing treatments for Parkinson’s, closed a £315,000 pre-seed equity round last year. Another startup, Clarity Sensors, which makes low-dose CT scanners, has raised £300,000 from UK Research and Innovation.

The university will benefit from any success, taking a portion of the licence fees or royalty payments from the companies it funds. “There is a clear commercial case” for the TIF, said Mentlak, although he admits that “the payback period is, unsurprisingly, quite long. It takes a long time to get some of these technologies to market.”

Still, the model appears successful enough that the UK government is eager to emulate it. In October 2024, Rachel Reeves launched a £40m proof-of-concept fund to “turn pioneering university research into successful companies”. Within months, the fund was massively oversubscribed. In May, TenU, a group spanning 10 universities, including Cambridge, that aims to commercialise their technology, warned that thousands of academics were set to miss out.

Related articles:

Photograph by Getty Images

Newsletters

Choose the newsletters you want to receive

View more

For information about how The Observer protects your data, read our Privacy Policy