In the flurry of results last week one company deserved particular attention. Tether, the world’s largest issuer of dollar-backed stablecoins, registered a whopping net profit of $4.9bn (£3.7bn) – a quarterly record for the crypto company.

For comparison, BlackRock’s net profit for Q2 2025 was $1.59bn and the highest profit ever recorded by a publicly traded company was $20bn, posted by Apple in the first quarter of 2018. Tether’s results, which follow the Genius Act, a piece of legislation passed by US Congress introduced to regulate stablecoin payments, are more miraculous given that the firm employs only 250 people. It may have the highest profit per employee of any company ever.

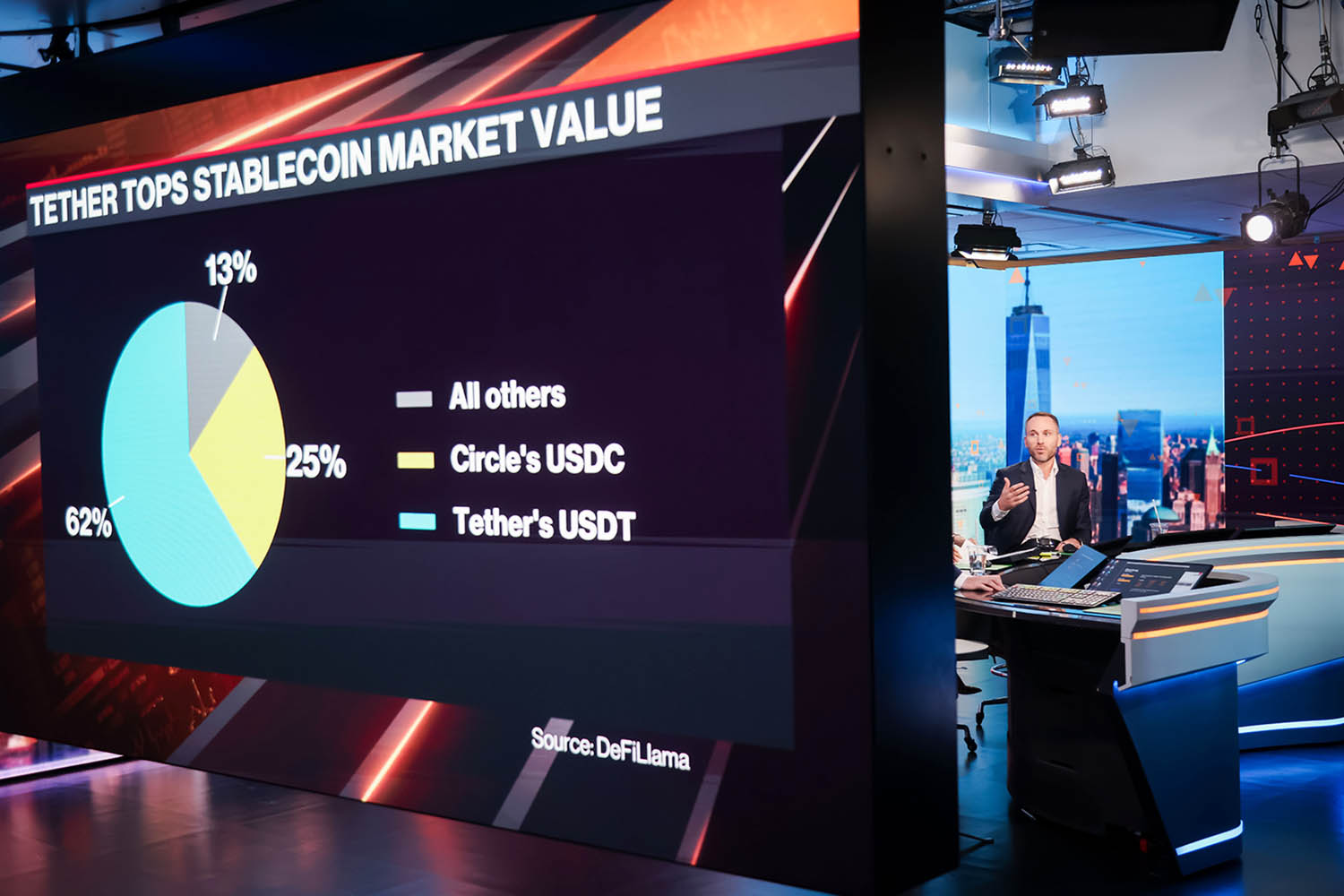

Tether, which moved its head‑ quarters to El Salvador in January, sits on one of the world’s largest piles of US Treasury bills, a pile that has grown from $120bn to $127bn in the past quarter and surpassing the amount held by Germany. It uses these – one of the world’s safest and most liquid investments – as a reserve to back its USDT stablecoin, a cryptocurrency pegged one-to-one to the dollar.

Recently, however, Tether has slowed its T-bill purchases and started spreading money into other assets, including Bitcoin, gold and company stocks. CEO Paolo Ardoino says the company has started investing in land and agricultural companies, as these are “scarce and safe assets” that historically tend to appreciate. In June, it became the second-largest shareholder in Juventus football club.

Dollar-backed digital tokens accounted for 63% of illicit transaction volumes globally in 2024, and investigations by the Economist and others have revealed that USDT’s stability, ease of use and low fees make it a favoured stash for organised criminals.

Tether says it has frozen or blocked more than $2.9bn in USDT tied to criminal activities across more than 5,000 digital wallets. This includes $23m linked to Russian sanctions evasion, $9m from the ByBit hack, and $1.6m linked to terrorism financing in Gaza. It recently made a strategic investment in blockchain analytics firm Crystal Intelligence to increase efforts to root out crime.

The International Compliance Association says stablecoins have become the “new epicentre of crypto fraud”. It adds: “Issuers can intervene in ways that purely decentralised cryptocurrencies cannot, yet that very capacity also raises questions about centralisation and oversight.”

This is especially, one might think, so if a company has so few employees.

Photograph by Michael Nagle/Bloomberg/Getty

Newsletters

Choose the newsletters you want to receive

View more

For information about how The Observer protects your data, read our Privacy Policy