Ten years ago my husband and I bought 16 solar panels and had them fitted to the house where we were living, which belonged jointly to us both. My husband filled in the form provided by our energy supplier, Ovo, to initiate the feed-in tariff (Fit). The form had space for one name. My husband died in 2022, but as I was still receiving his emails asking for readings and the payments were going into a bank account we held jointly at the time of his death, all seemed to be well, except that all communications were addressed to my husband.

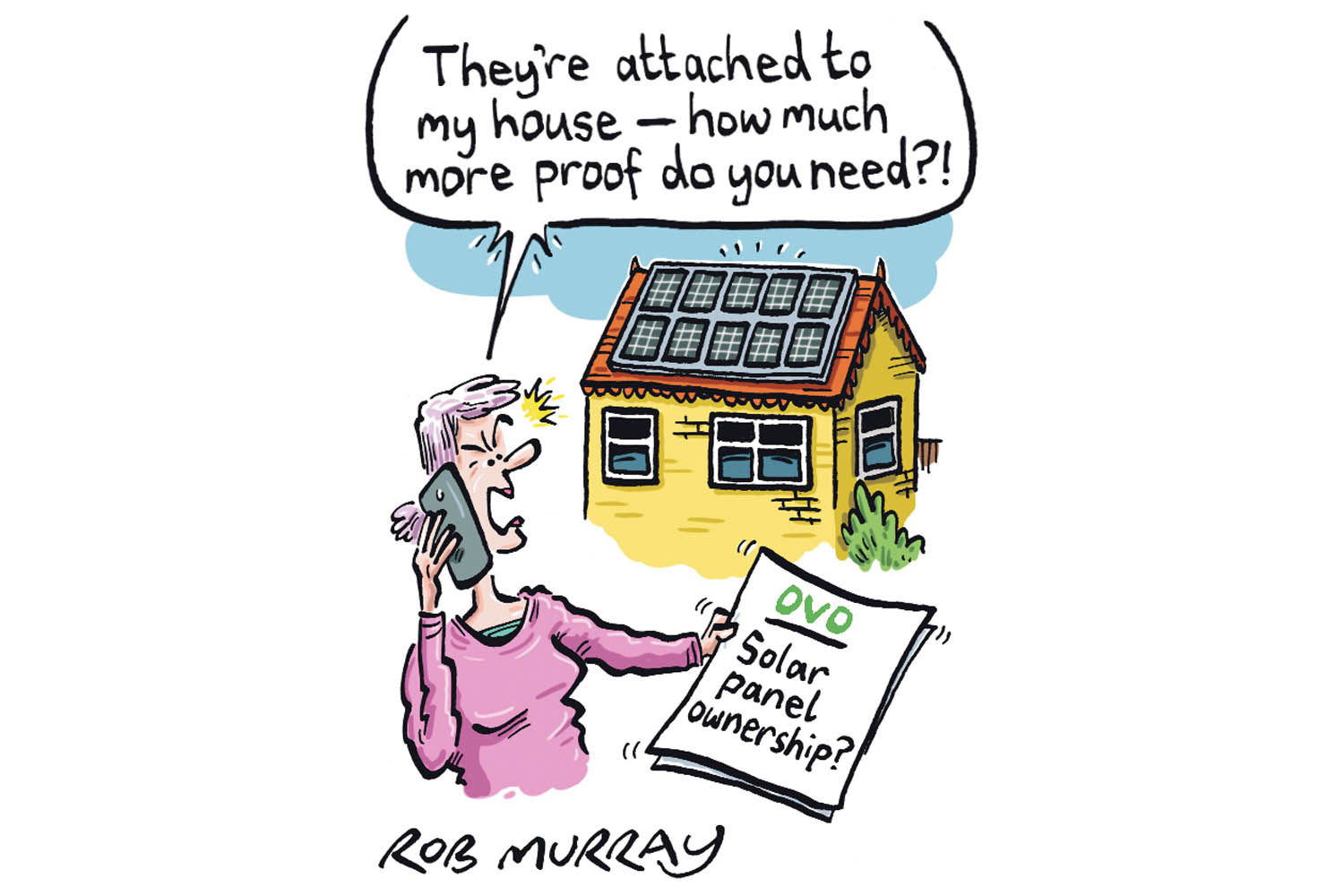

I notified Ovo of my husband’s death and sent the certificate. They asked for either a copy of the part of my husband’s will showing the panels belonged to me or a letter from a solicitor proving they belong to me. As the panels have always belonged to me and my husband, there is no documentation proving specifically that I am now sole owner of panels which are on my house, feeding electricity into my household circuits. I can prove, and have proved, my ownership of the house. That is all the solicitor could do, using Land Registry documents.

So we have reached an impasse, despite long conversations with Ovo’s complaints department, and they have frozen the payments.

I’d be grateful if you have any suggestions.

You and your husband used his bank account to pay for the panels, even though it was converted to a joint account later on, so this did not help prove that the panels were jointly owned.

I can’t imagine anyone in the history of writing wills specifically bequesting solar panels to someone, yet this is what Ovo was asking to see.

However, while your husband’s will made a few cash bequests to named individuals, the rest of his estate was left entirely to you. So even if the panels originally belonged to him, the will made it clear that they now belong to you. I sent the will to Ovo, pointing out the relevant section.

Ovo immediately contacted you to apologise. It told me that you have now been added to the Fit account and they will backdate payments to 5 December, when the payments were frozen, plus it offered you a bouquet of flowers and a cream tea as a gesture of goodwill in apology for the delay and stress caused.

You said: “I was distracted by assuming that my husband’s will couldn’t possibly say anything helpful because it was written before the panels were installed and circumstances had changed so much since it was written. And overall it was a complicated document. So thank you for bringing a fresh and clear eye to it.”

Nothing reassuring about Saga’s pricing

The renewal cost of our house insurance has gone up by a very unreasonable 525% from last year. We are an elderly couple living in the same three-bedroom terraced house in Twickenham for more than 40 years. For most of that time we have had insurance cover with Saga. There have been no major claims, just a few for items lost outside the home – an anorak in France, and my wedding ring – but none in the past five years.

Newsletters

Choose the newsletters you want to receive

View more

For information about how The Observer protects your data, read our Privacy Policy

For the last three years we paid £400 a year for Saga Plus. However, this year the renewal quote is £2,500. My husband phoned Saga to query the hike but it couldn’t give a plausible answer.

We have a quote from the Nationwide building society, which can give the same cover, except for accidental cover within the home, for £541. The renewal date is 18 May with Saga, and Nationwide will hold its offer until July. If you could throw any light on this matter we’d be very grateful.

Saga told me the increase was partly due to steep inflation during the past three years, and partly because the insurers on its panel have changed since you bought its policy. This has resulted in the insurer which provided your cover no longer selling insurance to Saga customers.

Rather late in the day, Saga suggested you switch to its one-year Select policy, which does not include cover for items away from the home and which you told me would cost around £1,300 a year – a lot more than the £400 you have been paying, or the £580 for Nationwide’s policy. However, you have decided to go with this policy while you check other options to ensure continued cover for subsidence, which your property suffered in the 1980s.

Email your problems to Jill Insley at your.problems@observer.co.uk