The Bonfire of the Vanities by Tom Wolfe (1987)

Finance has always been about more than numbers; it’s about people: their psychology, their ambitions and their fears. That’s what I tried to capture in Too Big to Fail and in my new book, 1929. Tom Wolfe’s exuberant satire of 1980s New York skewers the swagger of high finance. Following Sherman McCoy, a “Master of the Universe” bond trader, the novel unravels the intersection of money, politics, race and media frenzy. Both hilarious and tragic, it remains the definitive cultural portrait of finance at its most combustible – a reminder that markets are powered not just by numbers, but by vanity and ambition.

Manias, Panics, and Crashes: A History of Financial Crises by Charles P Kindleberger (1978)

Kindleberger’s masterwork is a guide to financial bubbles. He shows how every crisis follows the same arc: displacement, boom, euphoria, crisis and revulsion. The particulars change, but the models always work – until they don’t. From tulips in 17th-century Amsterdam to the speculative fever of 1929, Kindleberger demonstrates how markets repeatedly march towards excess, only to collapse under their own weight.

Reminiscences of a Stock Operator by Edwin Lefèvre (1923)

Wall Street traders still read this 1923 classic, and so do I. It has been described as a barely disguised biography of Jesse Livermore, a controversial trader who made a fortune during the crash betting that stocks would fall, but it feels like a confessional: the lure of speculation, the rush of the win, the devastation of loss. What I love is that, nearly a hundred years later, the wisdom still applies: you could hand it to a crypto trader today and they’d nod in recognition.

1929: The Inside Story of the Greatest Crash in Wall Street History by Andrew Ross Sorkin is published by Viking (£30). Order a copy from The Observer Shop for £27. Delivery charges may apply

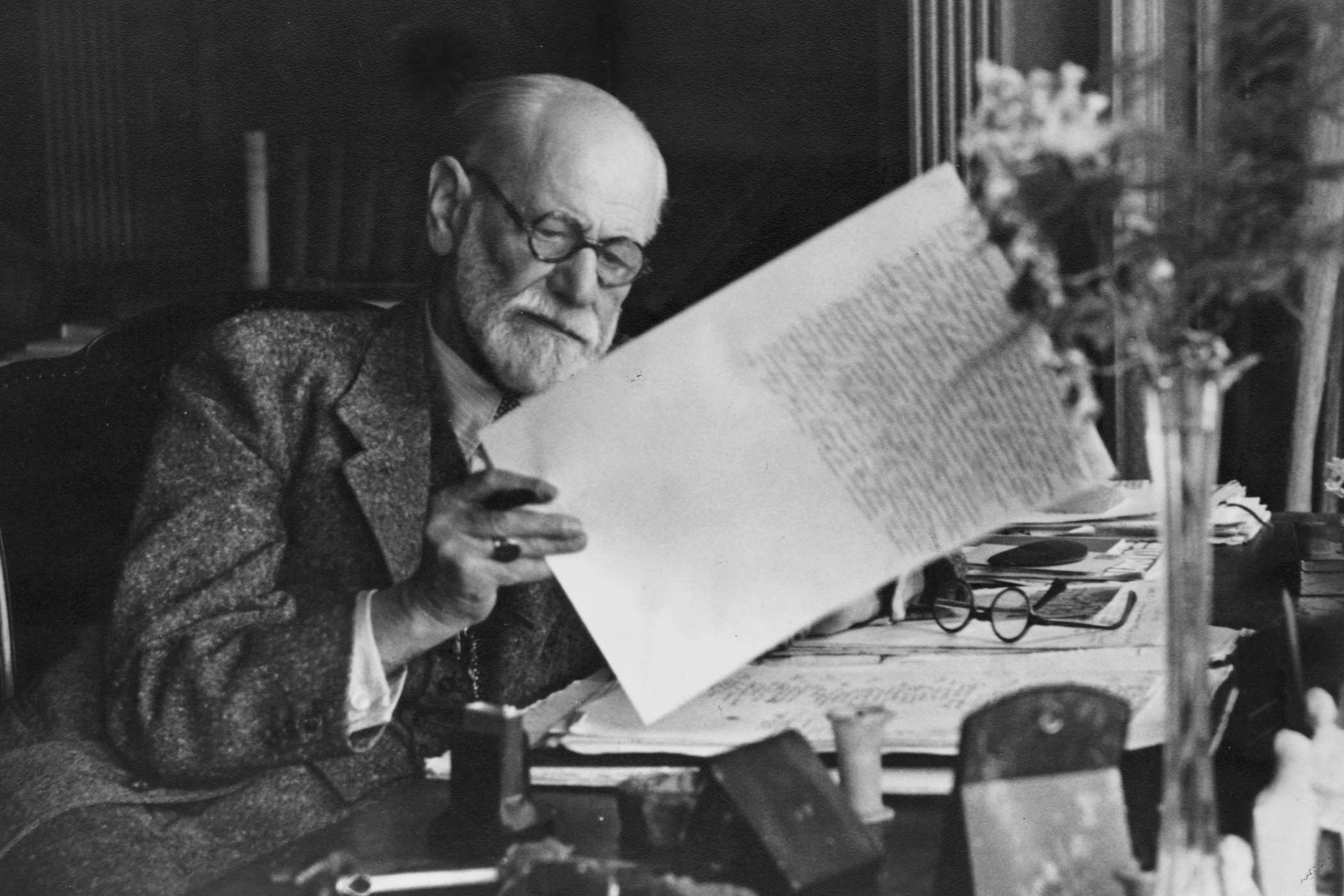

Photograph by Hulton Archive/Getty Images

Newsletters

Choose the newsletters you want to receive

View more

For information about how The Observer protects your data, read our Privacy Policy