Slowly, then all at once. That’s how the government’s “vision” for life sciences came to the brink of disaster in the space of a week.

It started with news on Wednesday that US pharma giant Merck would be scrapping a £1bn investment into a King’s Cross research hub, along with 125 jobs. Not long after, news emerged that AstraZeneca, Britain’s largest company, would be “pausing” a £200m research investment in Cambridge, while Mounjaro slimming drug maker Eli Lilly publicly revealed it was on the fence about a similar-sized investment in London.

None of this is good for UK economic growth, which tallied at precisely zero for the month of July. Drug manufacturers account for 17% of the UK’s business research and development spend. They are the patrons of Britain’s world-leading science spinouts and startups, and in the eyes of many investors a ticket to relaunch the UK as a growth powerhouse.

The straw that broke it was health secretary Wes Streeting’s decision to walk away from negotiations over the UK’s drug prices – which are a global outlier.

It’s some relief that, ahead of the US President’s Donald Trump visit this week, the UK government announced over £1.25bn of private US investment into Britain’s financial services sector from the likes of PayPal, Bank of America, Citi Bank, and S&P. Deals worth a collective £1bn on data centres from OpenAI and BlackRock are welcome too.

But one senior business adviser said: “In the last week, we have had Merck moving out of the UK and Ineos moving investment from the UK to the US. I can’t remember a time when we have had so many of those decisions in such a short period of time.”

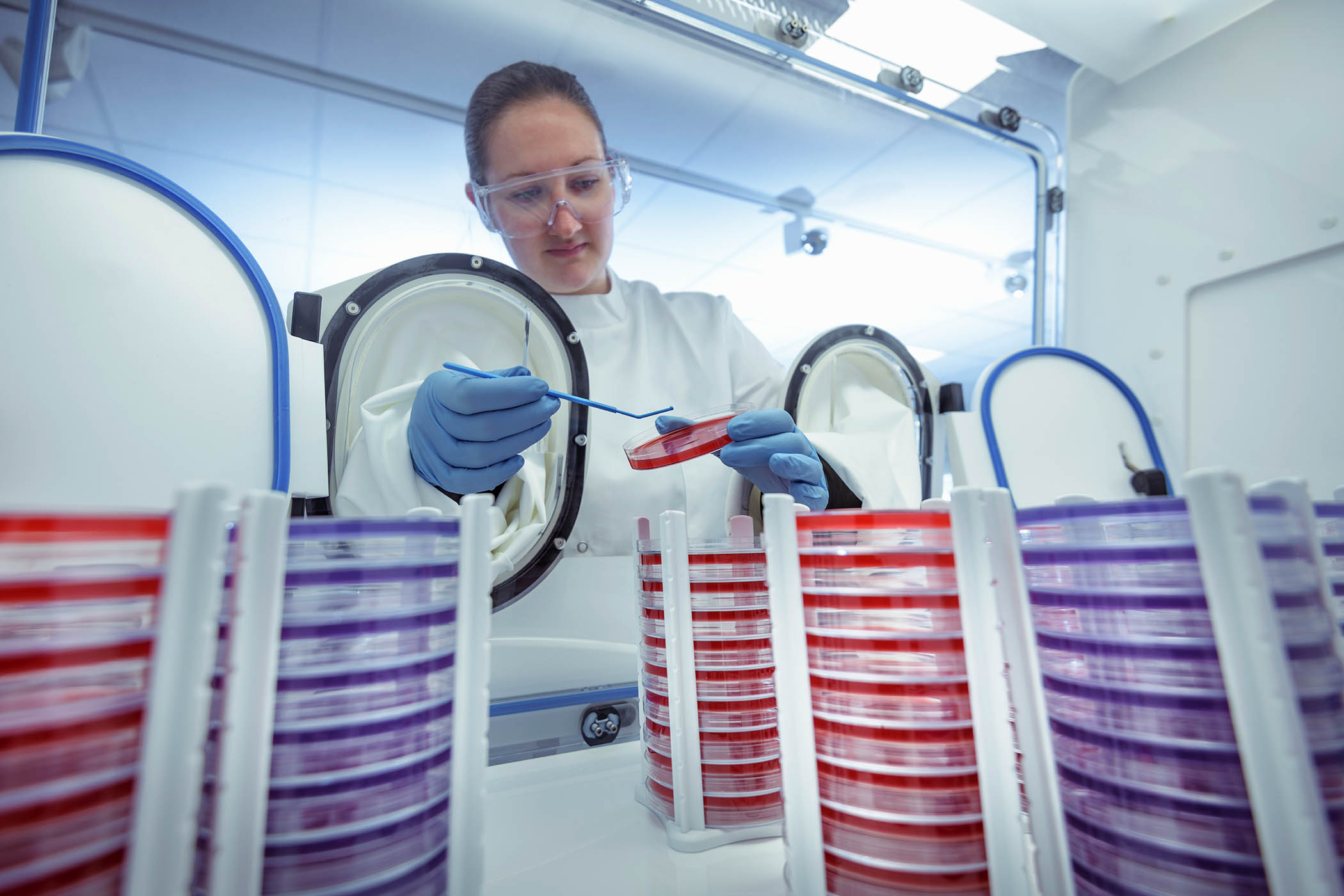

Photograph by Monty Rakusen / Getty Images

Newsletters

Choose the newsletters you want to receive

View more

For information about how The Observer protects your data, read our Privacy Policy

Related articles: