The party’s over and the hangover is blistering. Already battling global moderation in drinking habits, British distiller Diageo took a $200m hit from the trade war between the US and Europe last year, and suffered the sudden departure of its CEO.

The FTSE100 company – the business behind Guinness, Smirnoff and Johnnie Walker – is now one of the UK stock market’s worst performers, with shares trading at 10-year lows, a spectacular fall for a company that nearly doubled in market value between 2013 and 2023.

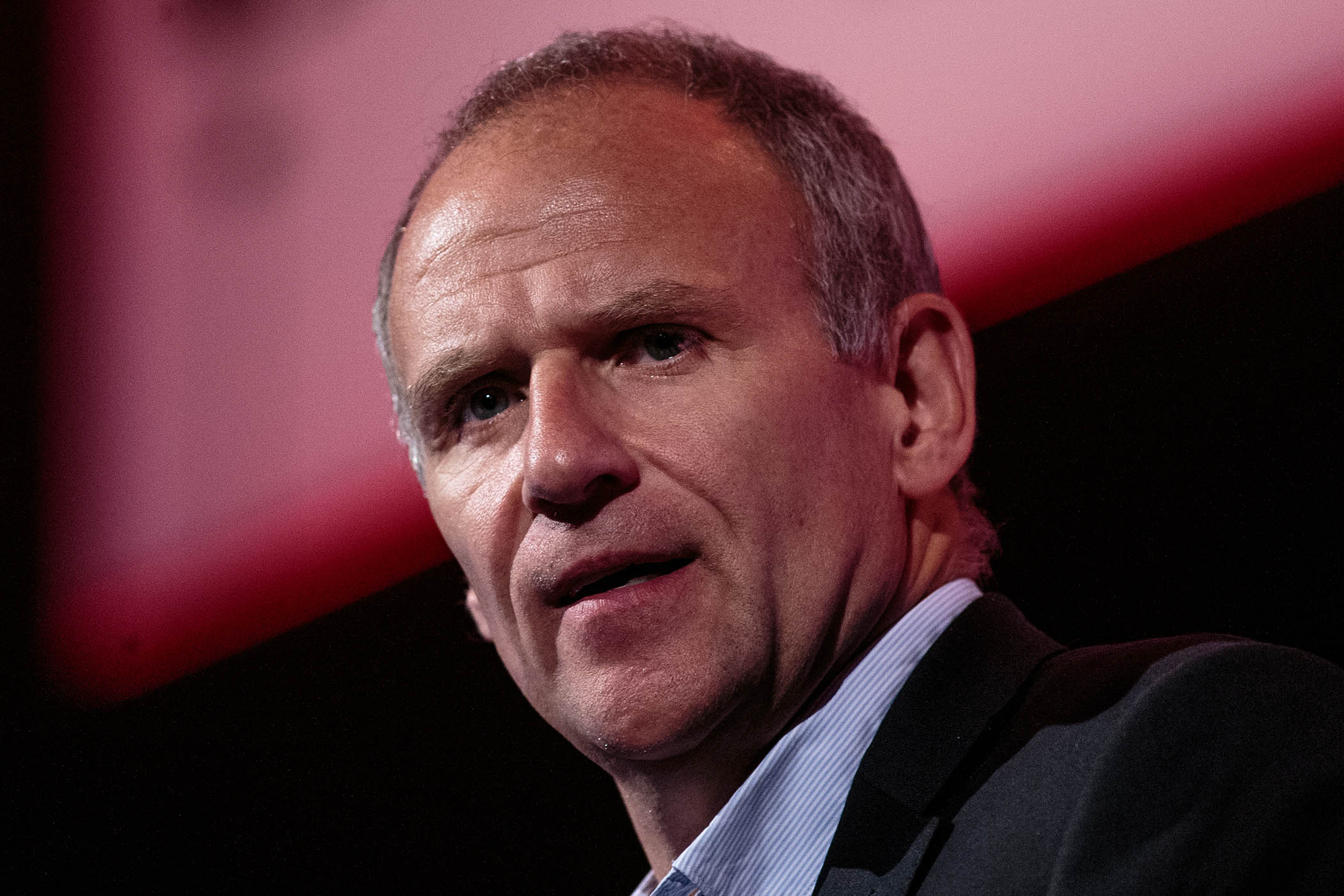

With interim results for the first half of fiscal year 2026 due next week, new CEO Sir Dave Lewis has to prove this glass is half full. Although the stock is up 12% over the last month, the company and analysts are predicting that sales will be flat to slightly down on the year before, the result of weak demand in the US and China. Lewis, who used to run Tesco and spent the last few years as chair of Haleon as well as working on an energy interconnector project, faces the challenge of navigating a shift in drinking habits, which have fallen to their lowest levels in decades. Across the developed world, beer drinking has been in persistent decline, but three-quarters of Diageo’s sales come from spirits, which have bucked the trend – until recently. Now, consumption of spirits is falling, too.

According to the consumer research company IWSR, the biggest driver of moderation in drinking is economic. Prices in the UK rose after the pandemic and have stayed high, and alcohol is an area where spending can be cut.

Marten Lodewijks, managing director of IWSR, said: “It’s not true that gen Z doesn’t drink. What is true is that they drink less frequently and often drink less when they do drink.

“If there is economic pressure on consumers, that is most felt by younger consumers, who are starting their careers. They drink with more mindfulness – it needs to be worth their money to go out.”

Weight-loss jabs may play a part, too. Terry Smith, the veteran fund manager, has ditched Diageo because he believes GLP-1s may diminish the appetite for alcohol.

Meanwhile, legalisation of cannabis in several US states has enabled a boom in THC-infused drinks, increasingly popular with customers looking for mood enhancement without a hangover. These are now popular enough to be stocked in Target stores.

A second major challenge is to reduce the company’s net debt, which stood at $22bn in June 2025. Diageo has been lightening the load by selling brands it considers marginal and selling off brewery assets in Africa. Buyers are circling Royal Challengers Bengaluru, the Indian Premier League cricket team Diageo owns.

Analysts at Fitch suggest that debt reduction will be a long road, with the leverage ratio remaining high for the next two fiscal years, limiting the company’s ability to absorb risks. These include the possible scrapping of the US-Mexico-Canada Agreement, which is up for renewal in July. Removal of tariff exemptions could have a $600m impact on Diageo, according to Fitch.

Newsletters

Choose the newsletters you want to receive

View more

For information about how The Observer protects your data, read our Privacy Policy

That’s the glass-half-empty narrative. A sunnier outlook runs like this: while moderation remains a drag on the business, alcohol consumption – like other discretionary spending – will recover. Meanwhile, the business can reduce its debt by selling off non-core assets and, perhaps, by scrapping its dividend (which happened at the start of Lewis’s Tesco turnaround). In the longer term, Lewis’s deep experience of retail and consumer-facing businesses – from Tesco to Unilever – will make a difference.

Sir Dave Lewis

Chris Beckett, equity research analyst at Quilter Cheviot, said: “He will be called in to front up with the likes of Tesco, Walmart, Carrefour, getting the right promotions, the right shelf space, the right relationships with retailers.”

Analysts and investors anticipate a leaner management style under Lewis, with a potential overhaul of the 14-strong executive committee (larger than average for a FTSE-100 company).

Kai Lehmann, analyst at Flossbach von Storch, an asset manager and Diageo investor, said Lewis was expected to trim fat. “Given his track record as a successful cost cutter and turnaround manager, we expect him to outline specific measures on how to reduce the enormous debt pile.”

Questions remain about the future of Nik Jhangiani, the CFO who is regarded favourably by analysts but was passed over for the top job. Diageo declined to comment on potential changes to the senior leadership team.

The impact of obesity drugs may be overstated. Diageo says it has been monitoring the impact of GLP-1s in the US but has not yet identified significant disruption to the spirits market. Spirits may be less vulnerable than beer to the GLP-1 effect, and evidence of the effect of weight-loss drugs on boozing is weak in any case. Lodewijks said: “If you look at our data, the GLP-1 user has tended to be a heavier drinker of alcohol to begin with, in terms of what they claim to consume, and they now say they are coming down.”

Expect a little more pain in next week’s results, but also the first indications of whether this battered business is worth toasting once more.

Photograph by Tim Clayton/Corbis via Getty Images