Eli Lilly has joined a number of pharmaceutical companies pausing or dropping investments in the UK following a fallout with the government over drug pricing.

Gateway Labs, a London-based hub that provides support for biotech startups – established last October as part of Lilly’s planned £279m investment in the UK – is on hold as the company “awaits more clarity” on the state of the country’s life sciences industry.

Lilly’s pause follows Merck’s scrapping of a £1bn London research hub and AstraZeneca’s decision to pause a £200m investment for research and development in Cambridge.

It’s understood that Novartis is keeping its UK investments “under review”. The US drugmaker has already reduced its UK footprint from seven sites, including two manufacturing plants in 2009, to one site based in London with 1,200 staff.

“This is a huge blow,” said Professor Dame Ijeoma Uchegbu at the UCL School of Pharmacy, commenting on the Merck announcement. “Resets such as these also harm up and coming companies who may have relied on upstream innovation.”

The pharma sector collectively contributed 13% of business R&D expenditure in the UK in 2023, according to a report released this week by PwC and the Association of the British Pharmaceutical Industry (ABPI).

The timing of announcements is no coincidence. Less than three weeks ago, negotiations broke down between the UK health secretary, Wes Streeting, and the pharma industry over the level of rebate drugs companies pay back to the NHS on sales of their products. This system ensures the NHS gets fair prices and predictable costs, while drug companies get faster access to the market for new medicines.

The Observer understands that the ABPI rejected Streeting’s proposal which suggested a clawback rate of 19% – lower than what was initially proposed, but onerous in the eyes of many pharma companies and out of step with most of Europe.

Related articles:

“CEOs are properly livid with the UK in an emotional way, it almost goes beyond just the business,” a senior source at a US pharma giant said. “There’s this feeling that there are ‘good bones’ in the UK… but this crashing of negotiations has really soured things.”

Pharma’s pullback from the UK has been months in the making and may not be wholly the UK’s fault. The Trump administration has been applying pressure on pharma companies to invest more in the US.

Newsletters

Choose the newsletters you want to receive

View more

For information about how The Observer protects your data, read our Privacy Policy

Ahead of the president’s state visit, an industry source said the government “had been straining sinews to keep pharma off the table”. Following the Merck announcement, that looks nigh impossible.

An emergency meeting of the Science Innovation and Technology select committee has been called for Tuesday to discuss the UK’s life sciences plan and drug pricing. The Observer understands that the ABPI, Merck, AstraZeneca and GSK have all been invited. It’s not clear, however, whether the government’s adviser Sir Patrick Vallance will attend due to a conflicting engagement.

Sir John Bell, a prominent immunologist at the University of Oxford, told the BBC this week there had been “overall undervaluation of innovative medicines and vaccines by successive governments”.

By the numbers, he’s not wrong. According to the report from the ABPI and PwC, UK pharmaceutical R&D investment had a “significant slowdown” in 2020, when annual growth fell to 1.9% a year, behind the global average of 6.6%, and hasn’t really picked up since.

“Startups and spinouts could still be successful despite diminishing presence of industrial heavyweights (the startups can still be bought by them) but it will hamper ability to scale these businesses,” said Henry Whorwood at Beauhurst, a data provider on private companies.

He added that investment could decrease because a large proportion of equity funding – 20% of deals in 2024 – involved foreign investors and the recent announcements will “dent optimism”.

Earlier this week, Julia Lopez, shadow secretary for science, said that Merck’s decision was “a klaxon sounding across Whitehall” but it’s clear that there is one department, above all, that will be held responsible if investments do ultimately leave.

“Big pharma’s demands “hit the immovable object of the Treasury,” the senior industry source said. “And I think it hit it at the worst possible time as well.” The Treasury did not respond to requests for comment.

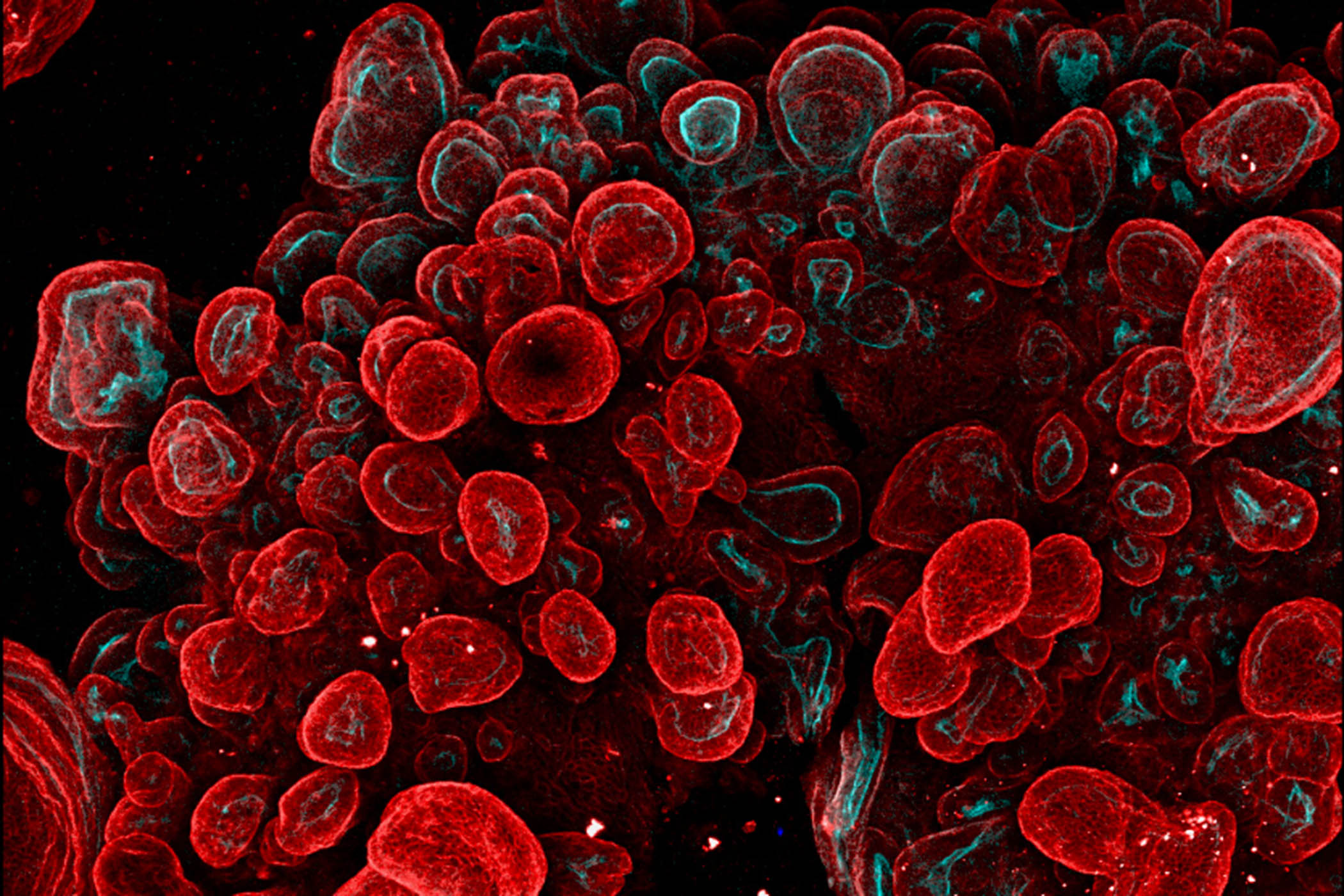

Photograph by Getty Images