RedBird Capital Partners, the US private equity group that agreed to become the new owner of the Telegraph in May, has submitted a formal request to the government to progress the sale, having secured buy-in from other investors for a deal that values the newspaper at £500m.

It now falls to Lisa Nandy, the culture secretary, to decide whether to issue a second public interest intervention notice (PIIN) which would trigger more investigations into a takeover that has been held up for months.

The DCMS was notified of the sale of a “call option agreement” on Friday afternoon. RedBird IMI, the Abu Dhabi-based investment vehicle led by Jeff Zucker, had to restrict its stake in the right-leaning newspaper after a new law capped foreign state ownership of UK titles to 15%.

Other investors include Daily Mail Group, which has reportedly taken a 9.9% equity stake for £35m, and billionaire Leonard Blavatnik, who is understood to have taken a stake of 10-20% through his company Access Industries, which last week also increased investment in DAZN, a sports streaming service, to £600m.

It’s not clear whether DMG and the Telegraph would coordinate printing or ad sales under the deal, or how this would be viewed by regulators.

RedBird would not comment on what proportion of the £500m was debt versus equity. “If it’s debt-funded, I’m not sure that will fly with the regulators, given that’s exactly what went wrong under the [previous owners the] Barclays,” says a media analyst. “Plus that promised investment, the sort of floated US expansion, would mean seriously loading the Telegraph back up with debt. Even with moderate leverage that wouldn’t stack – more like a 7-10 year exit than 3-5 years. Unless they think they can line up new partners post-clearance, I suppose.”

Nandy will have to decide whether to ease the existing interim enforcement order (IEO) blocking the private equity firm from control in the next few weeks. Assuming she does, she will then decide whether to trigger scrutiny of the deal by the media regulator Ofcom and the Competition and Markets Authority, which could take months. These bodies would examine the impact of the takeovers on the public interest and media plurality.

RedBird also announced it would be appointing Matthew Garrahan, head of digital platforms at the FT, as an operating partner. It follows the appointment of former CNN and Fox News executive Chris Wallace as an adviser.

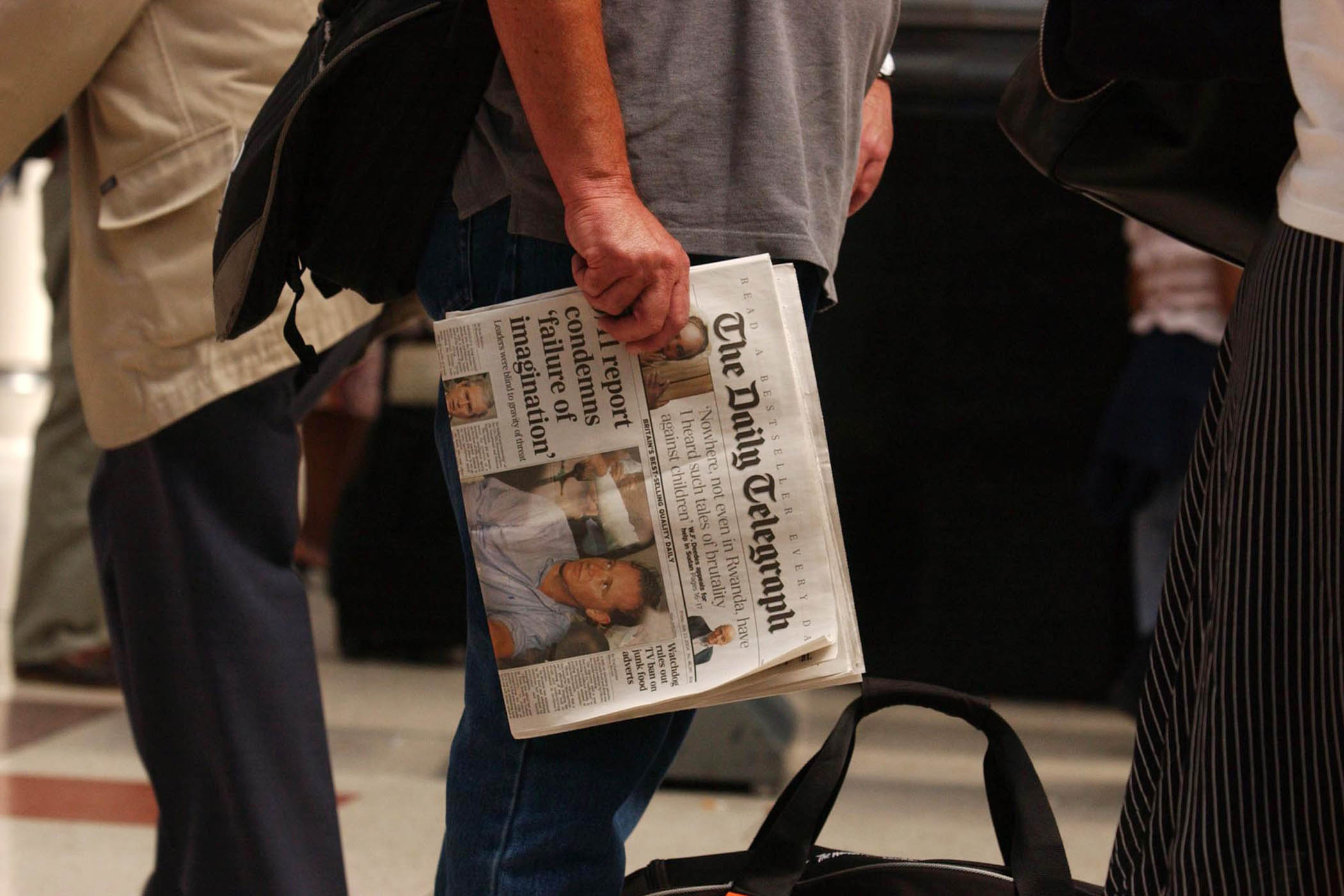

Photograph by Carl Court/Getty Images

Newsletters

Choose the newsletters you want to receive

View more

For information about how The Observer protects your data, read our Privacy Policy