It is one of the world’s most valuable companies, with a market cap of more than $1.3tn, but Tesla has reported a slump in sales for the second year running, losing its title as the world’s biggest electric carmaker.

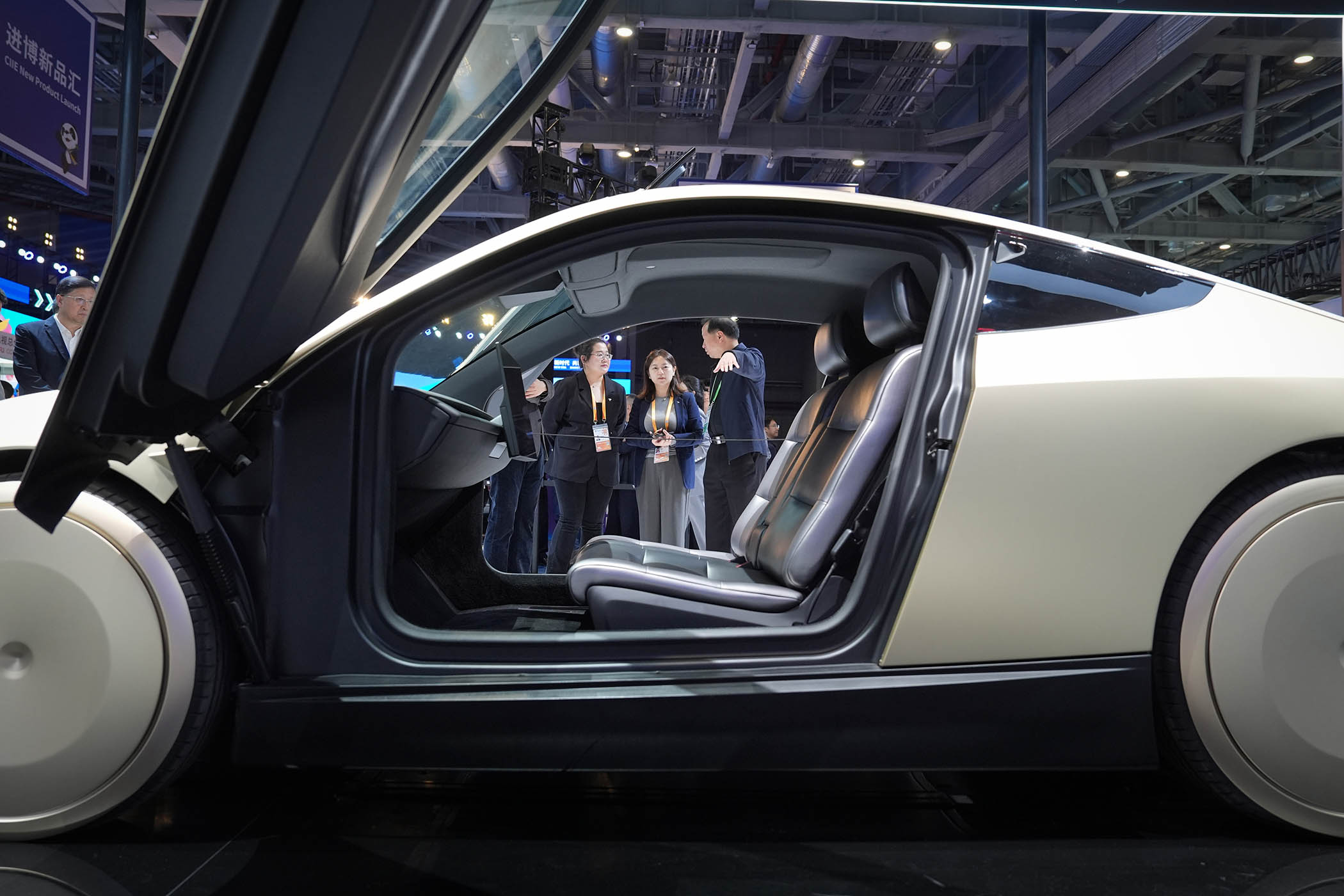

Elon Musk’s firm has seen sales drop in US and European markets, with China’s BYD now the world’s biggest seller of electric vehicles. BYD sold 2.26m vehicles in 2025, while Tesla delivered 1.63m vehicles.

Tesla has faced fierce competition, reduced subsidies and a backlash over Musk’s rightwing views and support for Donald Trump. UK registrations for Tesla cars fell nearly 20% in November to 3,784 from 4,680 cars a year ago.

Figures released on Friday reveal how global deliveries have stalled in the last two years. Annual production peaked in 2023, with 1.85m vehicles rolling off the assembly line.

In November, shareholders approved a potential pay packet for Musk which could be worth nearly $1tn and be the largest corporate payout in history. “Elon Musk just got $1tn for failure,” the protest group Tesla Takedown said over the pay packet approval. “Sales are down, safety risks are up and his politics are driving consumers away.”

Tesla is still the world’s most valuable car company and is worth significantly more than the value of Toyota, Ford and VW combined. Many investors will shrug off the decline in sales, considering its future value may be in the wider application of its technology.

Musk aims to make Tesla a global leader in driverless taxi services, known as robotaxis. He also has the ambition of manufacturing hundreds of thousands of Tesla bots, also known as Optimus robots, capable of performing what the firm describes as “unsafe, repetitive or boring tasks”.

Falling Tesla vehicle sales in the last year have not significantly dented the share price, which rose by more than 18% in 2025. The shares slipped 2.6% on Friday, with Musk now under pressure to successfully roll out its driverless taxi services.

US Tesla sales partly suffered after the withdrawal of electric vehicle subsidies by Trump. Consumers who previously bought EVs were able to claim tax credits of up to $7,500.

There has also been a wider global slowdown in sales of electrical vehicles, which are set for their slowest annual growth since the pandemic, according to reporting from the Financial Times.

Newsletters

Choose the newsletters you want to receive

View more

For information about how The Observer protects your data, read our Privacy Policy

BYD, or Build Your Dreams, was founded in 1995 by Wang Chuanfu. Warren Buffett bought a 10% stake in the company in 2008, saying it would become “the largest player in a global automobile market that was inevitably going electric”.

Photograph by Jiang Qiming/China News Service/VCG via Getty Images