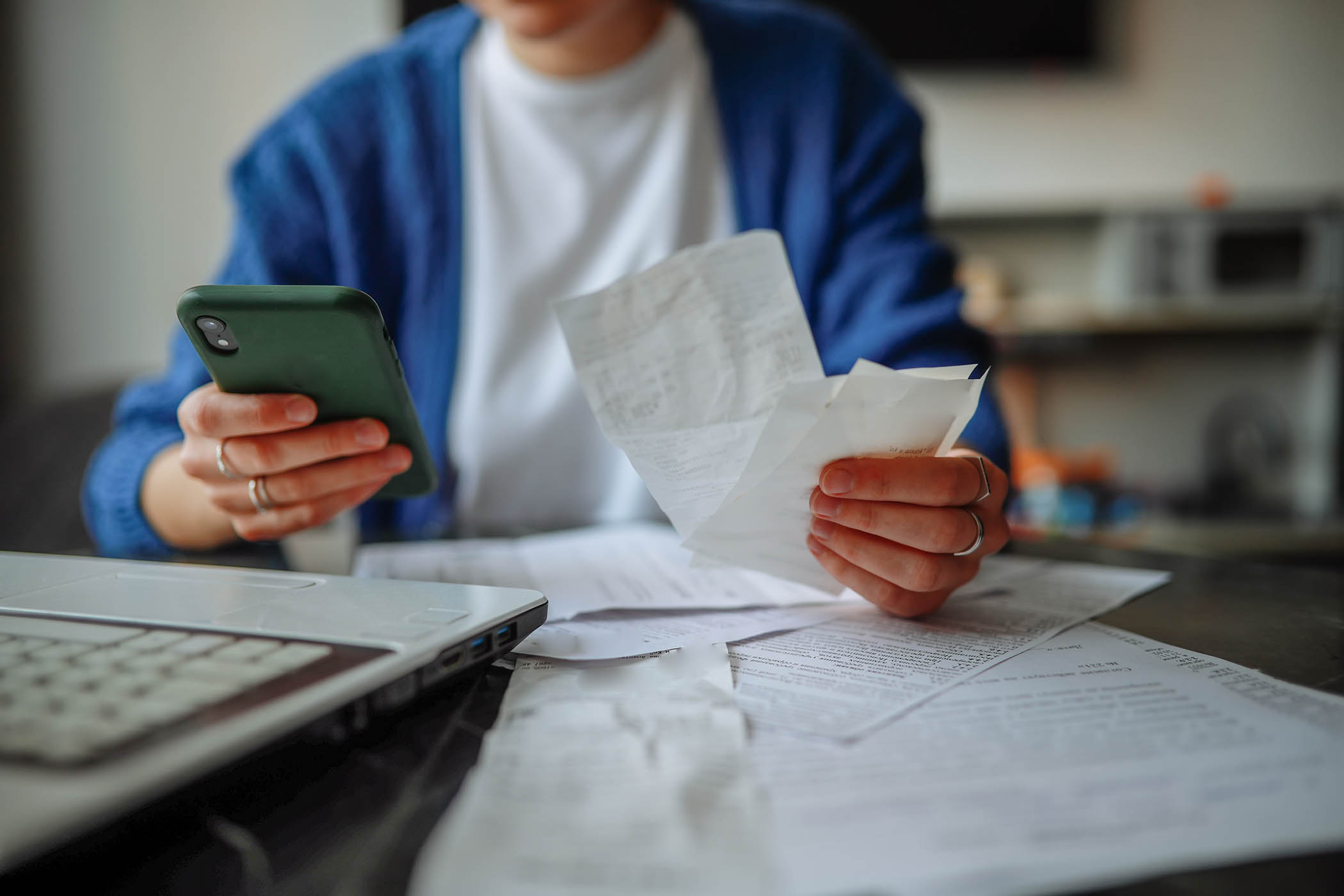

Banks are being urged to step up their efforts to identify and thwart economic abuse, which has affected one in six women in the past 12 months, according to the charity Surviving Economic Abuse (SEA).

Economic abuse – when abusers restrict, sabotage or exploit victims’ economic resources, often within personal relationships – has been recognised as a criminal offence since 2021, and the government’s violence against women and girls strategy published last month includes commitments to tackle it.

In an SEA survey of more than 1,000 women, one in eight who held a joint mortgage said they had suffered economic abuse as a result, and many were plunged into debt and homelessness. Now innovative research has brought together victim-survivors and banking professionals to propose new ways to tackle the weaponisation of financial products.

The charity found, in a 2025 report in collaboration with Northumbria University, that abusers routinely exploit everyday banking tools. It suggests that modest changes in product design and staff training could significantly reduce harms such as coerced debt, by which someone is obliged by a current or former partner or family member to take out or be responsible for credit. It accounts for more than £14bn of personal debt, according to the charity Refuge.

I investigated coerced debt for BBC Morning Live this month and met Maria – not her real name – who told me her ex-partner “had financial control of my future for 11½ years after walking out of that relationship”. She discovered he had saddled her with a joint mortgage, eventually forcing a repossession, which undermined her credit rating for another six years.

The debt charity StepChange says progress has been made with UK Finance’s Financial Abuse Code, but it estimates that almost one in eight of its clients have experienced coerced debt, which affects 3% of the UK population.

The report does not name the banks that took part in the study, but notes that Barclays, Lloyds Banking Group, Nationwide, NatWest and Starling have specialist economic abuse teams.

Research leader Clare Wiper, assistant professor in criminology at Northumbria University, said: “Banks have significant opportunities to be more proactive, and this isn’t always about massive investment or revolutionary technology – sometimes it’s about asking one additional question during joint account opening or ensuring that digital banking features are designed with victim-survivor safety in mind.”

The group’s report identified two areas as prioritised interventions: enabling banks to become aware of abuse through either customer disclosures or proactive detection of unusual patterns, with the support of specialist trauma-aware staff; and changing the terms and conditions of joint accounts. This would treat account holders as if they were in joint home ownership, as “tenants in common”. Banks could then split account balances in cases of abuse, and could also require both customers’ consent for large withdrawals.

The report urges UK banks to help test the proposed interventions and to develop workable protections.

Newsletters

Choose the newsletters you want to receive

View more

For information about how The Observer protects your data, read our Privacy Policy

Eric Leenders, managing director of personal finance at UK Finance, said: “Economic abuse is totally unacceptable and leaves long-lasting effects on victim-survivors. The financial services industry is committed to supporting [affected] customers with a wide range of help available, tailored to each individual circumstance. Surviving Economic Abuse’s report highlights the existing support the industry is providing, which we continue to develop.

“We want to go further, and we are working with government and the [Financial Conduct Authority] to reduce the risk of our services being used to commit economic abuse.

“If you are experiencing economic abuse, please reach out to your financial services provider as soon as you feel safe to do so.”

Photograph by Getty Images