Autumn, season of mists and mellow fruitfulness, wrote Keats. Not if you’re in the plant-based food industry. Sales at major brands, including Oatly and Beyond Meat, are stalling.

In the US, sales of alternative milk fell 4.4% in the past year, according to NielsenIQ, while American meat sales rose 5%. It looks wintery for these “good food” pioneers, and Beyond Meat’s share price – now slipping back after a 1,000% surge – is bewitched by some pre-Halloween meme-stock trading. Not the kind of stalwart support the plant-based burger company was hoping for.

But Ben Black, executive director of Verlinvest, an Oatly shareholder, is philosophical. “Clean food started in the late 20th century, and we’re in the middle of something pervasive.”

The current articulation is gut health, he says, and in the “post-protein world” Oatly’s fibre-rich formula will find favour. A new lucrative food chain has been created by GLP-1 weight-loss drugs, such as Ozempic, whose users need to eat more protein and more fibre.

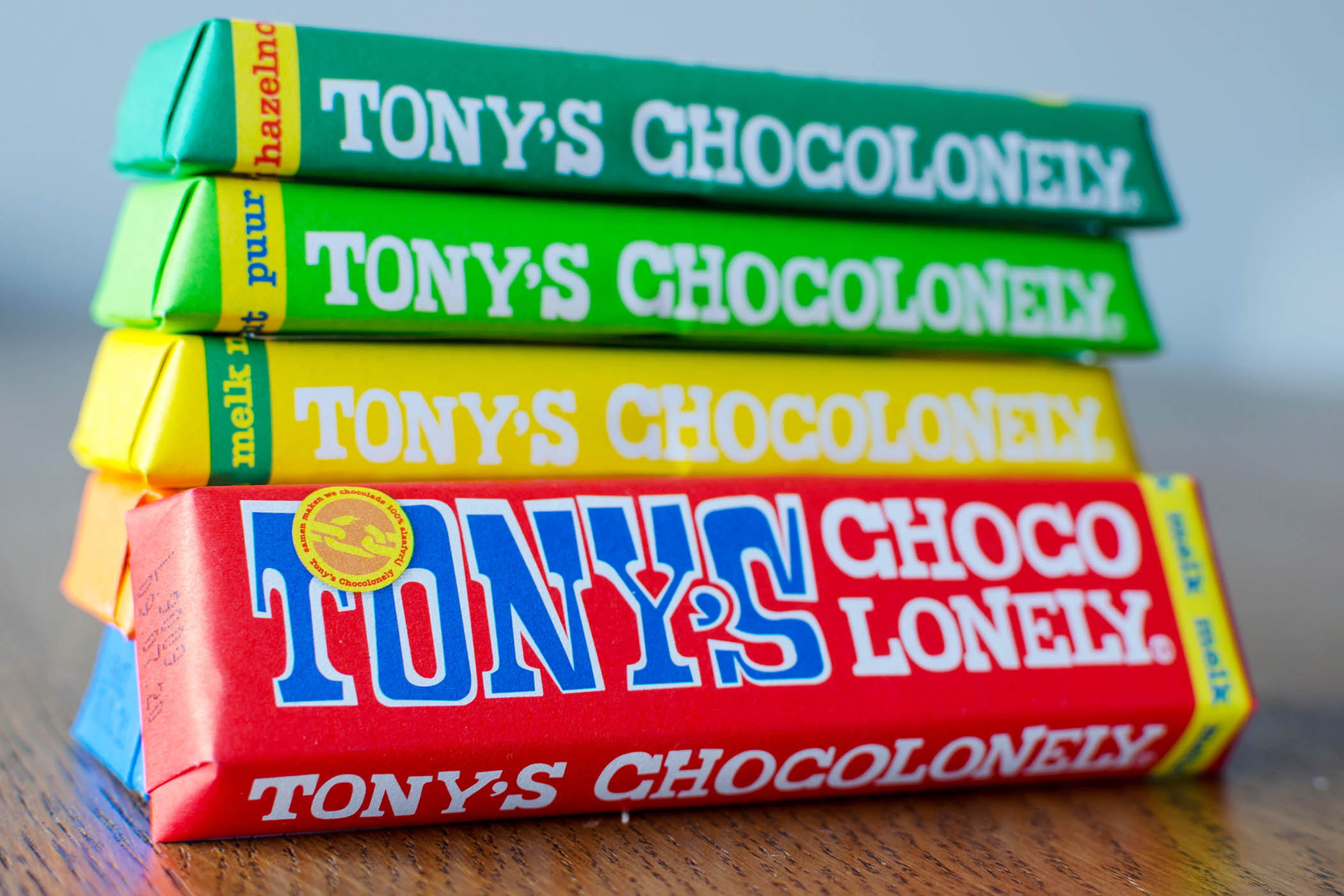

But all admit the market is tough. Inflation persists, customers are pinched and the battle for shelf space is fierce. “Brands must emphasise their true value proposition,” says Black, “and sharpen how they communicate it.” For example, Tony’s Chocolonely, another Verlinvest asset, has sustainable cocoa credentials and a mission to eliminate supply-chain child labour but wins the shelf war with great-tasting chocolate.

Selling sustainability is hard. Why? Black thinks it’s “shifts in political discourse, culture wars and perhaps an overstep of conventional environmental, social and governance (ESG)”. But funding for sustainable consumer offers is scarce. For Rachel Smith, head of innovation at sandwich giant Greencore Group Plc, “consumers seldom act on sustainability nor will pay”. Then why bother? “Because it’s the right thing to do,” she says.

Sustainability is a work in progress but “healthy food is here to stay”, says Smith, who has seen plenty of false dawns in 20 years in research and development. Giles Brook, veteran of Innocent Drinks and Vita Coco, believes “purpose will become a prerequisite”. Brook invests in zeal: “I want founders who light a spark. Then I’m all in.”

Karen Farrell, vice-president of brand services for Presence, a US natural products broker, says the key is “winning at each placement from independent shops to big-box retailers”. Built-for-good businesses have a supply-chain advantage over established operators, whose articles of faith are uniformity, speed, cost and volume.

Related articles:

Farrell also advises brands to “build shiny new things and be in front of buyers annually”. She wonders if Oatly might have exploited “out-of-carton” ideas like oat bars and cereals. Competition is intense and margin often beats meaning.

One success factor is time. Many advise business growth should be as organic as organic food and warn of private equity’s haste. For example, Flawsome! Drinks, founded in 2018, has invested £1m and claims profitability on £5m sales. Oatly, founded in 1994, forecast its first profit in 2026.

Newsletters

Choose the newsletters you want to receive

View more

For information about how The Observer protects your data, read our Privacy Policy

For Andy Waugh, co-founder of Sixes, a bar chain, nothing beats nature itself. “We say we are obsessed with eating healthily but are led by branding and price,” he says. “Why don’t we eat more offal? It’s cheap and more nutritious than steak. Why not venison? More protein than beef, completely wild and the world’s most ethical, high-margin meat”. Instead, says Waugh, “we eat Brazilian beef from farmers who decimate rain forests”.

We say we are obsessed with eating healthily but are led by branding and price

We say we are obsessed with eating healthily but are led by branding and price

Andy Waugh, founder of Sixes

That habits are hard to break is borne out by Greencore, whose top 10 sandwiches have not changed in 20 years. Only 1.5% of the UK is vegan.

It’s not yet clear what impact Maha – the Make America Healthy Again political movement championed by the US administration – has made on sales. Its manifesto calls for action on ultra-processed foods and a return to natural ingredients – but that also captures emissions-intense meat and dairy products (note US secretary of health, Robert F Kennedy Jr’s, appetite for raw milk).

As the planet heats up, so will regulation that favours sustainability. According to Future Market Insights, the global plant-based food market is forecast to grow at 12% per year, reaching $44bn (£33bn) in 2035.

But in 2025, good food requires spending power the affluent are as subject as anyone to the St Augustine prayer: “Lord, make me pure but not yet!”