This weekend is the moment the world crossed the economic rubicon. Until now the open, trade-friendly system built and expanded after the second world war, the midwife of unprecedented global growth and peace, still held – if only just. It may have been riven with imperfections and compromised by great power politics, but it nonetheless leaned in to openness and the principle that there are common global interests. No more. It has been killed stone dead by President Trump,

On 1 August the US unilaterally imposed tariffs on goods imported into the US from a further 90 trading partners at the highest average rate for 80 years. It is an economic Pearl Harbour – one of the singularly most hostile unilateral economic acts ever perpetrated. But there has been no resistance. Only China had the heft to be the exception, daring to fight tariff fire with fire, so winning a fragile pause in the tariff wars and, potentially, a partial reprieve.

The rest of the world has been bullied into negotiations that violate the great trade treaties that they had signed up to in good faith, but which Trump chose to shred. More extraordinarily, they have even kissed the hand that is throttling them. Japan has created a half-trillion-dollar fund to invest in key US industries to be identified and managed by Trump, with the US to be accorded 90% of the profits. Similarly, South Korea will buy $350bn of US goods and will give Trump $100bn to invest as he directs. The EU has not gone quite this far; nonetheless, it says it intends to buy $750bn of US fossil fuels and invest $600bn into the US. In return, Trump has halved his proposed tariffs on all of them from 30 to 15%.

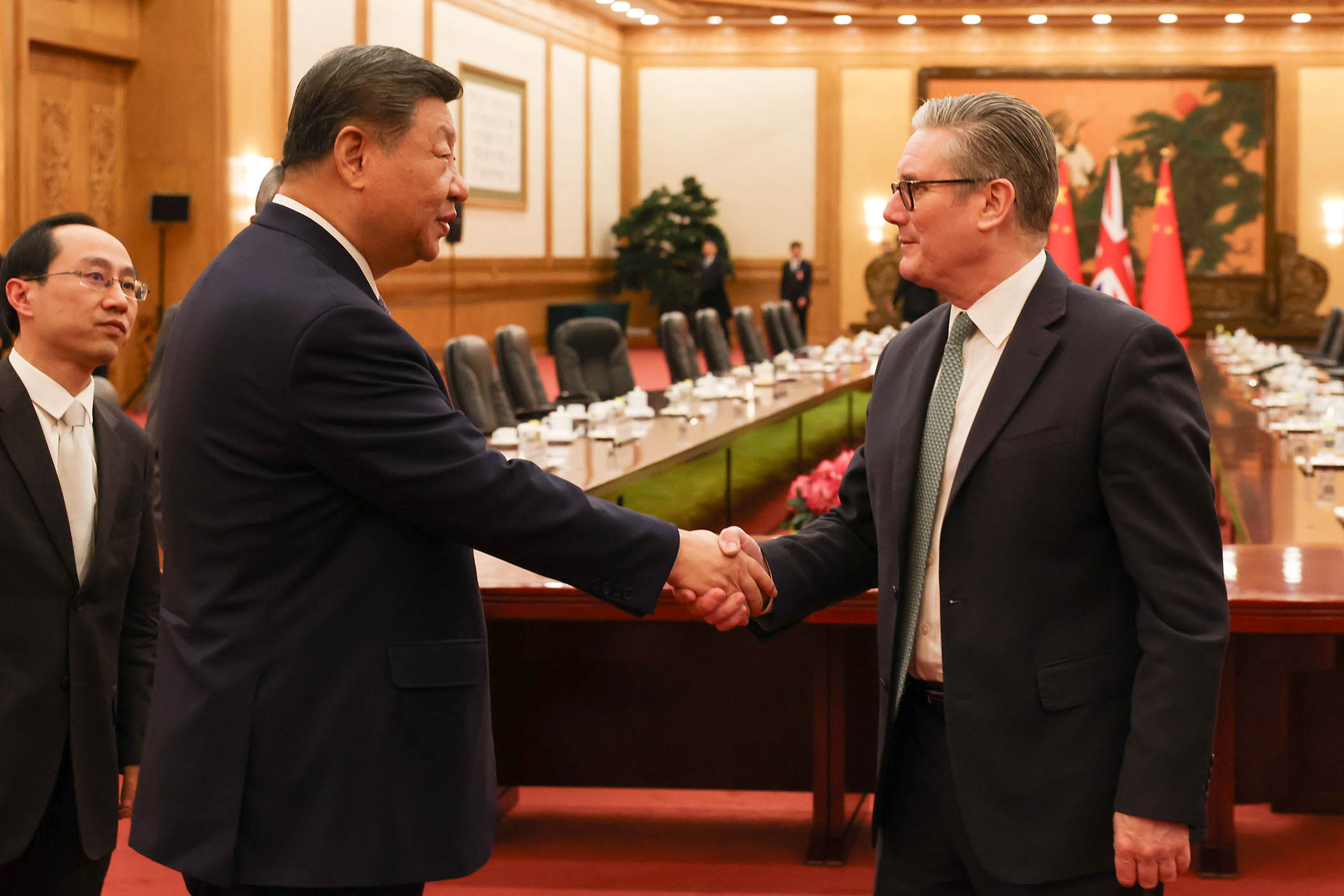

By comparison, those toe-curling scenes of Sir Keir Starmer in the White House handing an invitation from King Charles to Trump to spend some nights in Windsor Castle, seem a cheap price to pay. We got our 10% tariff – the lowest possible – and made no promise to invest, say, half a trillion dollars in the US. And we have that “US-UK Economic Prosperity Deal”. On the other hand, Trump knows the US already squeezes the British lemon hyper-dry; we are a vassal state dominated by US corporate, financial and tech interests adept at paying little or no UK tax, as Angus Hanton powerfully argues in Vassal State. There is not much more to squeeze.

For America, what’s not to like about substituting the World Trade Organization, with a de facto trade imperium?

For America, what’s not to like about substituting the World Trade Organization, with a de facto trade imperium?

A similar fate now awaits the rest of the world. There is growing recognition in most countries that in the name of realism they have in effect accepted vassalage to the US. Imperial rulers will come back for more tribute. Those critics are right. Yet domestically Trump rides high. What’s not to like about substituting the World Trade Organization, disliked by Republicans and Democrats alike, with a de facto American trade imperium? As for tariffs, the US could not continue running escalating merchandise trade deficits of more than a trillion dollars ad infinitum. Countries in surplus like China and Japan, as well as the EU bloc, were not correcting them. Now at least there will be some rollback and even if only a few blue-collar jobs return to the rust belt, that is better than not trying.

Trump has won large funds from South Korea and Japan to invest in US business, as comparably big as those President Biden planned under his Inflation Reduction Act. Wall Street has been touching new highs, mesmerised by the opportunities of superintelligence. The annual R&D and wider capital investment spend of the tech companies on AI are mindboggling – and as the world bends the knee to Trump, he has been careful in all his tariff wars to maximise the opportunities for US tech. Factor in the record tax cuts from the “One Big Beautiful Bill Act” and the Trumpian story is complete. He broke the rules, say his cheerleaders, and he won.

But don’t mistake relief that it could have been so much worse to mask this moment’s serious threats. Asian and European stock markets on Friday fell concerned about the economic hit both blocks are taking, while the hitherto strong US stock market suddenly showed faultlines. The tiny growth in US payroll numbers, much lower than expected, was the overt cause – but that only exposed an underlying economic softness. Almost every substantial American company’s business model hinges on being part of a global network that the US had built and policed. Now there are unexpected tariff costs and supply breakdowns. Think the dependence on Canada. And if foreigners decide they don’t want to hold dollar assets, who is going to buy the avalanche of US government debt about to be unleashed?

More importantly, there are global common interests – and one of them is trade. What is the point of having the US in the World Trade Organization if it doesn’t accept the fundamental principles on which it is built, argue two influential trade economists, professors Henrik Horn and Petros Mavroidis. It hasn’t paid its dues for two years. Kick the US out and start again. Others argue that like-minded countries should come together to found an open global trade bloc.

Related articles:

These are arguments that can only gain ground. But after the US’s withdrawal from the World Health Organization, its expulsion from the WTO would only remove another building block in the UN system. How will the US AI giants ever get managed for the common good in such a world? Yet this is where we are. The age of impunity is upon us. Hatred of the other and extreme self-interest, the hallmark of the contemporary right, are the enemies of prosperity and peace. We will all regret the rubicon that was crossed last Friday.

Photograph by Ronaldo Schemidt / AFP

Newsletters

Choose the newsletters you want to receive

View more

For information about how The Observer protects your data, read our Privacy Policy